International equities

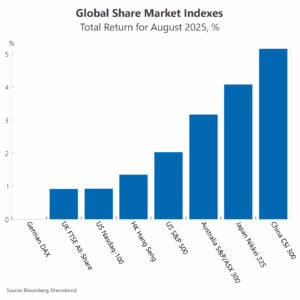

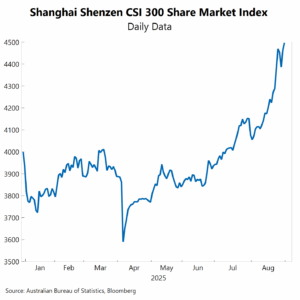

In August, most major global equity indexes posted solid gains, led by China’s CSI 300, which surged 10.5%. Abundant liquidity, renewed demand for non-US assets and government efforts to rein in aggressive price competition fuelled the rally. The strength in Chinese equities lifted broader emerging markets, though developed markets still outperformed. According to Morgan Stanley Capital International (MSCI) indexes, emerging markets returned 1.2%, while developed markets delivered a stronger 2.5%.

Most major share markets also hit new record highs during the month, including the US S&P 500 index, the Nasdaq, the UK FTSE 100 index, Japan’s Nikkei 225 index and China’s CSI 300 index. The German DAX bucked the trend to slide 0.6% in August but remained significantly higher year to date.

The strong finish disguised a shaky start to August for global equities, after soft U.S. non-farm payrolls data sparked concerns about a US economic downturn. This contributed to a sharp sell off in global equities in early August. Concerns about the fraying of independent institutions also emerged after US President Trump fired the Commissioner of Bureau of Labor Statistic, Erika McEntarfer, accusing her of manipulating the jobs data, although no evidence was presented.

Equities rebounded strongly, with the S&P 500 hitting a new peak on 28 August, driven by rising expectations that the US Federal Reserve would cut rates at its mid-September meeting. Those expectations gained momentum after Fed Chair Jerome Powell’s Jackson Hole speech on 22 August. By month end, markets were pricing an 87% probability of a September cut and more than five cuts by the end of next year. Still, risks of stagflation loom as inflation pressures persist while the labour market softens. Trade policy uncertainty also remains elevated, despite new US trade deals signed in late July and August.

The US Federal Reserve’s Board of Governors turned more dovish in August, as US President Trump pressed ahead with efforts to reshape the seven-member body around his easing agenda. On 7 August, he nominated Stephen Miran to replace Adriana Kugler, who had resigned earlier in the month. On 25 August he moved to oust Lisa Cook. She has refused to resign and is now challenging her removal in court. Two of Trump’s existing appointees, Michelle Bowman and Christopher Waller, had already voted for a rate cut on 30 July, underscoring the tilt in policy direction. At the same time, Trump has intensified attacks on Jerome Powell. As the Fed prepares to cut rates in the near term, concerns are mounting over the US central bank’s independence and credibility.

Expectations of a September rate cut in the world’s largest economy spurred small cap stocks higher. The Russell 2000 index returned 7.0% in August while the broader S&P 500 index returned 2.0%.

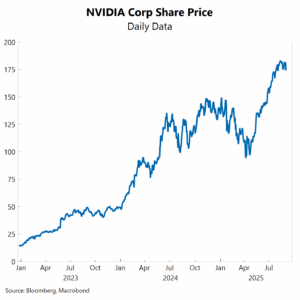

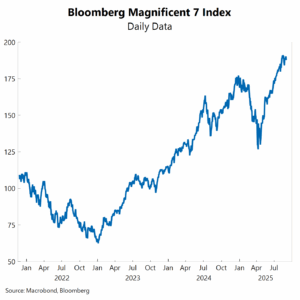

Technology shares were volatile in August as doubts over the durability of the AI rally intensified. On 20 August, sentiment soured after the OpenAI CEO warned of overheating in the sector and a MIT study reported that 95% of enterprises are seeing no value return from generative AI investments. Mid-month, the Trump administration struck a controversial deal with Nvidia, allowing AI chip exports to China to resume in exchange for a 15% revenue share for the US government. Although Nvidia beat earnings expectations on 29 August, its stock slipped amid broader market weakness. Overall, the Bloomberg Magnificent 7 Index returned 2.0% for the month.

Australian equities

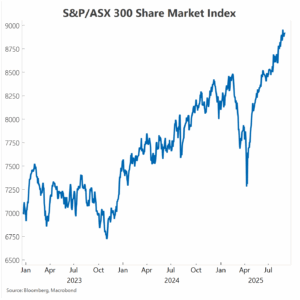

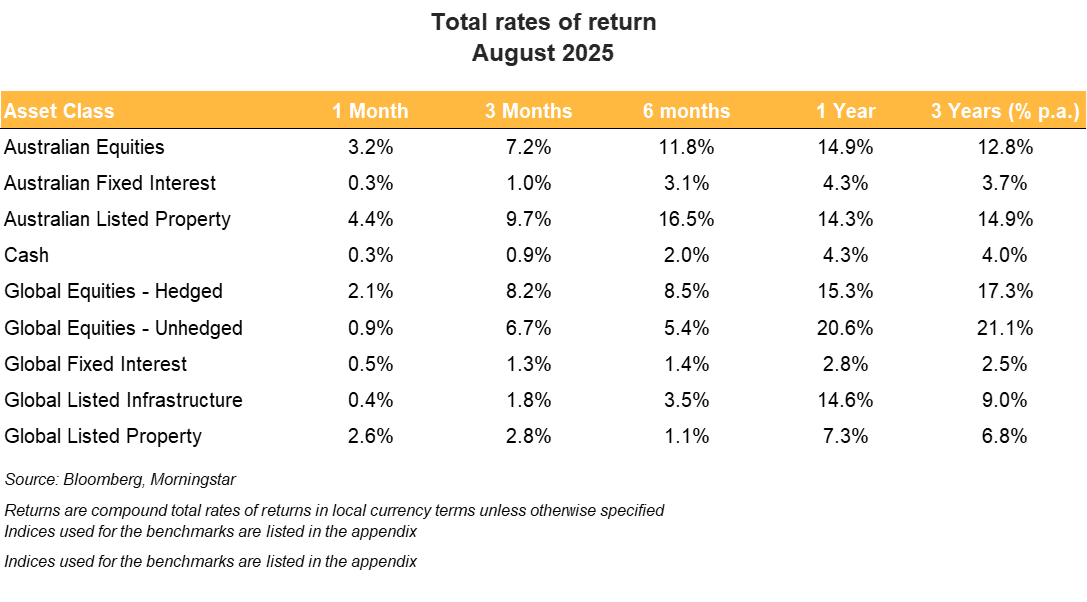

The S&P/ASX 300 climbed to a fresh record high on 21 August, posting a 3.2% return for the month after July’s solid 2.4% gain. Over the twelve months to end August, Australian equities delivered a robust return of nearly 13%.

Like global equities, Australian shares opened August with a sell-off but rebounded strongly. The rally was underpinned by the Reserve Bank of Australia’s (RBA) third rate cut of the year on 12 August, bringing total easing to 75 basis points. Guidance from the RBA Governor and updated forecasts suggest further cuts lie ahead, though rhetoric from the central bank suggests they remain committed to a gradual approach. A drop in unemployment to 4.2% in July and a surprise uptick in the monthly inflation gauge reinforced expectations that the easing cycle will be measured. By the end of August, interest-rate markets were pricing in two more RBA cuts by mid 2026, down from three at the start of August. The next move is priced for November, in line with our William Buck view.

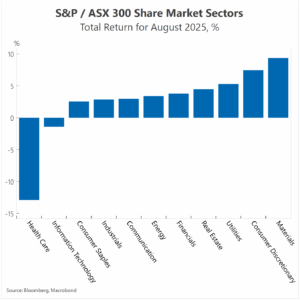

Market performance in August was driven by materials (+9.2%) and consumer discretionary (+7.3%). Within materials, Coronado Global Resources and Pilbara Minerals delivered standout gains. In consumer discretionary, familiar brands Adairs, Nick Scali and Harvey Norman ranked among the top ten performers. The combination of improving consumer sentiment and the RBA’s August rate cut boosted demand for these more cyclical stocks.

Of the eleven sectors, only health and information technology posted losses in August. The health index slumped 13.0%, led by sharp declines in Clarity Pharmaceuticals (-31.8%), Telix Pharmaceuticals (-30.6%), and CSL (-21.4%). CSL’s sell off, triggered by market unease over a restructuring program, dominated headlines. In information technology, weakness was concentrated in stocks tied to data centres and AI, including Audinate, Wisetech, Macquarie Technology Group, and Xero. A global sell-off in AI and tech shares spilled into the Australian market after the OpenAI CEO warned of a potential bubble and an MIT study highlighted that few AI firms are currently delivering real returns.

Fixed income and currencies

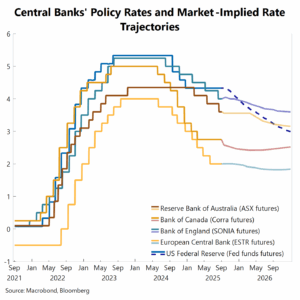

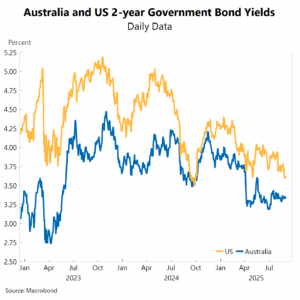

Markets now expect five more rate cuts from the US Federal Reserve over the next 12 months. This is a clear shift from only four cuts priced in just a few months ago. The pivot followed Fed Chair Powell’s Jackson Hole address, which triggered a steep drop in US 2-year Treasury yields. In August, those yields fell 34 basis points, marking the biggest monthly decline in a year.

Elsewhere, expectations for further rate cuts are far more muted. Markets see just one more cut in Canada and the UK, two cuts in Australia and nearly two in New Zealand. The Eurozone has no further easing fully priced in while Japan stands apart with a rate hike expected over the coming year.

During August, the RBA cut the cash rate for the third time this year and the UK’s Bank of England cut its bank rate for the fifth time.

At the long end of the curve, government bond yields were mixed. The US 10-year yield fell 15 basis points, though it stayed within this year’s trading range and at elevated levels, reflecting investor concerns over the long-term sustainability of US debt. Yields at the long end also eased in New Zealand and Canada, while edging higher elsewhere, including Australia, Germany, Japan and the UK.

The rally in US Treasuries lifted global fixed interest, delivering a 0.5% return in August, though performance across regions was mixed. Australian fixed interest returned 0.3% over the month.

The US dollar extended its gradual recovery after the sharp sell-off that began in January and bottomed on 1 July. In August, the US dollar index rose 0.3% on average, with gains broad-based across currencies. The Australian dollar fell 0.6% against the greenback, trading within a tight 0.6415–0.6519 range, before pushing higher late in the month as Fed Chair Powell signalled a possible September rate cut.

Property and infrastructure

Australian listed property maintained strong momentum in August. Support came from favourable currency moves and an improving domestic backdrop after the RBA eased policy. Both the US dollar index and the Australian dollar (in trade-weighted terms) strengthened over the month, adding to performance tailwinds.

National property values also continued to climb. The Cotality measure of home values rose 0.7% in August, which is the sharpest monthly gain since May 2024. The advance was underpinned by tight supply, firm demand, improving affordability, rising real wages growth and limited housing stock.

Supply constraints were especially evident in the capital cities, where home values reached new record highs in several capital cities (Sydney, Brisbane, Perth and Adelaide). Market momentum has also been reinforced by lower variable mortgage rates, following the RBA’s third rate cut of the year in August.

The real estate investment trust (REIT) sector delivered further gains. Goodman Group continues to stand out, benefitting from robust demand for data centres driven by the AI boom and infrastructure partnerships with global giants like Amazon and Microsoft.

Economic outlook

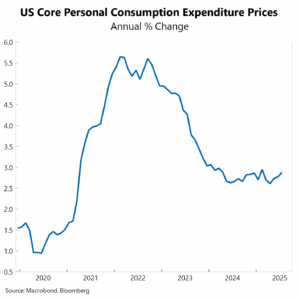

The US Federal Reserve is preparing to ease policy as soon as mid-month. Political pressure and early signs of labour-market weakness have led markets to price a US rate cut in September, with four more expected over the next twelve months. Yet uncertainty remains high. US tariff announcements remain frequent and inflation risks are still tilted upward. The Fed’s preferred gauge, the core personal consumption expenditure deflator, has risen for three consecutive months to 2.9% in July – well above the 2%. The steepening of the US yield curve underscores concerns that inflation will prove sticky.

If the Fed caved to political pressure to cut rates aggressively, markets would question its independence and credibility. That would likely drive long-dated Treasury yields higher as investors demanded more compensation for inflation and policy risk, steepening the yield curve. Australia’s bond market would not be immune. Australian longer-term yields would rise in sympathy, even if domestic conditions didn’t warrant it, given the pull of global capital flows. At the same time, the USD could soften against major currencies as confidence in the US economy and its institutions, which have long underpinned global capital flows, erodes.

Equity markets remain in a phase where optimism still dominates, but that optimism is increasingly being tested by fundamentals. The recent volatility triggered by OpenAI’s CEO warning on the AI sector highlights how fragile sentiment has become. Both US and global markets remain vulnerable to bouts of turbulence, with investors appearing complacent about the balance of risks. The questioning of AI-related valuations has already prompted some rotation into value stocks.

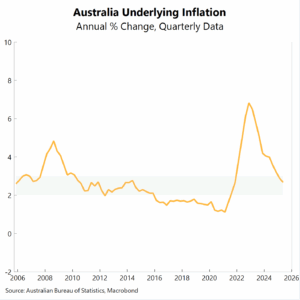

In Australia, a stronger recovery is unfolding, with a deeper improvement in consumer spending growth. Underlying inflation is easing toward the middle of the RBA’s 2-3% target band. That trend should support the RBA’s cautious, gradual approach to policy easing, with rate cuts expected but delivered more slowly than in the US.

Disclaimer

This report has been prepared for general informational purposes only and does not constitute personal financial advice. It does not take into account your specific objectives, financial situation, or needs. Before acting on any information in this report, you should consider its appropriateness in light of your circumstances and seek independent financial advice. No representation or warranty is made as to the accuracy, completeness, or reliability of the information contained herein. Past performance is not a reliable indicator of future performance.