International equities

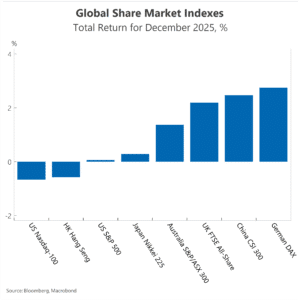

Global share markets delivered modest returns in December 2025 as investors approached the year ahead with greater caution. In hedged terms, global equities returned 0.5% for the month, supported by strong gains in European markets and across emerging economies. However, in unhedged terms, global equities declined by 0.9%, reflecting currency movements over the month.

Performance varied significantly across regions. The strongest major market was Germany’s DAX index, which rose 2.7% in December. European markets benefited from improving sentiment regarding the region’s growth outlook and indications that policy settings may become more supportive in 2026. Japan and China also ended the month firmer. In contrast, the broad US market was more subdued; the S&P 500 share market index delivered only a marginal rise and the Nasdaq 100 declined as large technology names came under pressure. Indeed, investors placed greater scrutiny on the substantial capital expenditure being directed toward artificial intelligence (AI) related projects, contributing to renewed volatility within the sector. Warnings from US President Trump in late December about potential military action against Venezuela added to geopolitical tensions and contributed to a more cautious tone in US equity markets.

Despite a mixed December, global equities posted strong gains in 2025. A defining feature of the year was the resilience and confidence exhibited by investors despite unusually high levels of uncertainty. Over the 12-month period, global equities returned 11.5% in hedged terms and 9.0% in unhedged terms, navigating tariff shocks, geopolitical tensions and heightened economic uncertainty. A notable development was that every major asset class delivered positive returns in 2025; it’s the first time this has occurred since the COVID period. Gains in global equities were broad based, though a significant source of strength came from companies linked to AI, semiconductor manufacturing and digital infrastructure.

Emerging markets produced particularly strong results in 2025, supported by renewed interest in rapidly growing technology ecosystems and stronger than expected export conditions, even amid elevated US tariffs. Korea and Taiwan were standout performers, benefiting from global demand for chips and components tied to AI deployment. China’s market delivered a more uneven performance, but still made a positive contribution.

The broader investment landscape shifted meaningfully over the year. The US Federal Reserve’s move toward a more accommodative stance in the second half of 2025 helped underpin risk appetite, even as concerns grew about the sustainability of earnings within the technology sector. On 10 December, the US Federal Reserve cut the federal funds rate by 25 basis points and announced that it would begin regular purchases of Treasury bills from 12 December 2025. Although the Fed described these as technical “reserve management purchases” intended to maintain ample liquidity rather than a shift in policy direction, markets interpreted the move as a form of balance sheet expansion aimed at easing funding conditions.

Australian equities

Australian equities rebounded in December, delivering a total return of 1.4% after losing 2.6% in November, despite rising expectations that the next move from the Reserve Bank (RBA) would be a rate hike. Economic data in the latter part of the year signalled persistent underlying inflation pressures, pointing to the end of the RBA’s short lived and shallow rate cutting cycle. The rate cutting cycle lasted only six months and totalled 75 basis points.

However, the uplift in Australian equities in December was not broad based, as investors were more selective in their stock choices. This selectivity was evident in the fact that only three of the 11 share market sectors rose in December – materials, financials and real estate. Materials posted the largest gain of 6.8%, driven by a rise in commodity prices, especially iron ore and gold.

The largest drag came from the information technology and health care sectors. Concerns about stretched valuations weighed more heavily on IT stocks, while another sharp decline in global bio tech company CSL’s share price (falling more than 7%) pulled the broader health care sector lower. Both sectors mirrored the weaker performance seen in their global counterparts.

For the full year, Australian equities delivered a total return of 10.7%, which is a solid outcome and comfortably above the long run average. However, this result still fell short of the stronger gains recorded across global equity markets. Three rate cuts between February and August helped support local shares through much of the year, but by late 2025 market attention had shifted toward the possibility of tighter monetary policy in 2026. Inflation data released over the December quarter showed an unwelcome rise in underlying inflation. Furthermore, both the RBA’s December meeting rhetoric and the accompanying minutes reinforced speculation of a potential rate hike in 2026. Notably, the December meeting marked the first time in 2025 that the Board did not discuss the option of a rate cut and fresh RBA forecasts pointed to further increases in annual inflation rates through the first half of 2026.

As in December, materials was the standout sector for 2025, delivering an impressive total return of nearly 40% for the year. Within the sector, six stocks generated returns exceeding 200%; the largest of these by market capitalisation was Pantoro Gold, rising by 219.6%. In contrast, health care and information technology underperformed sharply, recording losses of 23.8% and 19.1%, respectively. CSL remained under pressure throughout the year and was among the ten worst performing stocks, falling 37.5%. In IT, well known names such as WiseTech and Xero also featured in the list of major underperformers.

|

|

Fixed income and currencies

Global fixed income markets navigated a shifting monetary landscape in December. The US Federal Reserve lowered the federal funds rate by 25 basis points to a range of 3.50%–3.75% on 10 December and markets are pricing two further cuts in 2026. The Fed also began adding liquidity to money markets through regular Treasury bill purchases, described as technical “reserve management purchases” but widely interpreted by markets as balance sheet expansion.

In contrast, Australian fixed-income markets reflected a different policy direction. The RBA kept the cash rate unchanged at 3.60% at its December board meeting, but a renewed lift in inflation pressures over the second half of the year shifted expectations decisively. In early 2025, market sentiment favoured ongoing easing, but by December, markets were firmly pricing in a rate hike in the first half of 2026.

The divergence in monetary-policy expectations contributed to a widening of both the 2-year and 10-year yield differentials between Australian and US government bonds, supporting demand for the Australian dollar (AUD). The 2-year spread widened by 29 basis points in December to 58 basis points and the 10-year spread widened by 10 basis points to 57 basis points.

Australia’s annual underlying inflation rate rose to 3.4% in the September quarter, the top of the RBA’s 2-3% inflation target band and contributing to a move higher in longer term yields. The Australian 10-year government bond yield climbed to 4.74% by year’s end, up 38 basis points over 2025 and 22 basis points higher in December alone. Meanwhile, the Australian 2-year government bond yield increased to 4.06% by year’s end, up 25 basis points in December and 20 basis points higher over 2025.

US 10-year yields also moved higher in December, rising from 4.01% to 4.18%, though they remained below the 2025 peak of 4.81% recorded in mid-January. Fiscal concerns were a defining feature of global bond markets in 2025, particularly in the US, placing pressure on long dated government bonds. In contrast, US 2-year yields fell by 2 basis points in December to end the year at 3.48%, which was 77 basis points lower than a year earlier. The feared tariff driven inflation spike did not eventuate and signs of rapid labour market cooling prompted the US Fed to cut rates by 75 basis points in the second half of the year.

Currency markets reflected the divergence in rate expectations. The AUD appreciated against the US dollar over both December and the full year, supported by higher domestic yields and firmer commodity prices. It rose 1.23 US cents in December to 0.6673 and gained 4.85 US cents over 2025. The AUD also strengthened against the Japanese yen and the New Zealand dollar over both periods. While it firmed against the euro in December, from 0.5647 to 0.5682, it still declined against the euro over the year. On a trade weighted basis, the AUD rose 1.6% in December and 4.2% over 2025. This supported hedged global equity exposures in December. However, unhedged global equities still outperformed relative to hedged global equities by 6.1 percentage points over 2025, as strong offshore equity gains outweighed the drag from a firmer Australian dollar.

The US dollar index (i.e. DXY) fell by 9.4% in 2025, the steepest decline since 2003; the euro was a major beneficiary, rising 13.4% against the US dollar, and the British pound appreciated by 7.6%. After accounting for currency moves, European equities were the top-performing index in local currency terms.

Property and infrastructure

Global listed property finished last year on the back foot, returning –2.8% for December, as rising long term bond yields in most major economies and uneven global monetary signals kept investors cautious toward sectors sensitive to funding costs. Even with this softer end to the year, the asset class still delivered a modest 0.7% return for 2025, supported by steady performance in defensive real-estate segments such as logistics, health care and residential linked assets. International investors began re-entering real estate selectively towards the end of the year, but global rate uncertainty meant capital flowed cautiously. Indeed, investors remained highly focused on income resilience.

Australian listed property, by contrast, recorded a stronger result, returning 2.0% in December 2025, helped by tight rental markets, strong migration and constrained housing supply. Across the full year, the sector returned 9.7%, reflecting solid domestic fundamentals even as interest rate expectations shifted near the end of 2025 towards a rate hike. This evolving backdrop means investors remained selective, favouring higher quality and yield oriented segments such as residential, logistics and health care real estate.

Infrastructure also softened into the end of 2025. Global listed infrastructure returned –3.5% in December 2025 amid the same pressure from rising global long term yields. Yet for the full year, the sector still achieved a 7.2% gain, supported earlier by dependable cash flows from essential service and transport linked assets.

Economic outlook

The opening weeks of 2026 have brought a renewed bout of global uncertainty with developments in US politics shaping market sentiment. The criminal investigation into Federal Reserve Chair Jerome Powell has reopened concerns about central bank independence, a cornerstone of inflation targeting frameworks. It has contributed to a stronger bid for safe haven assets.

Global conditions have also been unsettled by an upswing in geopolitical risk. Investors are watching US actions involving Venezuela, elevated tensions in the Middle East, including Iran, and a series of unexpected foreign policy signals such as comments about Greenland. Some observers view Washington’s intervention in Venezuela as a revival of the Monroe Doctrine, signalling a more overt effort to reassert control over strategically important resources in the western hemisphere. The crisis has also drawn attention to the fragilities of the petrodollar system established in the early 1970s, particularly as Venezuela’s oil-for-yuan trade with China highlights how some producers are increasingly capable of operating outside the US-dollar based framework.

These dynamics have intensified demand for alternative stores of value, helping propel gold to a record high of US$4,641.88 per troy ounce on 14 January. Bloomberg’s consensus points to US$4,747/t oz by year end and some analysts see a break above US$5,000/t oz as plausible. Other metals, including copper, have also hit fresh record highs while oil prices have strengthened.

In Japan, speculation that Prime Minister Sanae Takaichi may dissolve parliament for a snap election on 23 January has placed renewed pressure on the yen, which has fallen to an 18-month low against the US dollar. Markets are focused on whether Japanese authorities will intervene to stabilise currency movements.

At the same time, persistent fiscal deficits across major economies and the increasing influence of fiscal dominance are reviving concerns that inflation may remain more persistent than previously expected. These themes intersect with diverging policy paths globally. Financial markets expect further policy easing in the US and UK, while the euro area appears to have reached the end of its easing cycle. By contrast, tightening is expected in New Zealand and Canada. Japan is likely to continue its gradual normalisation. Domestically, we continue to expect one RBA rate increase in May, although an earlier move remains possible if the 28 January inflation print surprises to the upside.

This environment argues for greater selectivity in investing, especially in interest-sensitive sectors in Australia. Income quality and defensiveness should continue to command in Australia a premium unless inflation convincingly resumes a downward trajectory.

This backdrop also reinforces the need for selectivity, particularly in interest sensitive sectors in Australia. Quality income streams and defensive characteristics are likely to remain in favour unless inflation shows a clearer downward trend. Recent market movements also highlight the importance of portfolio diversification, disciplined valuation anchors and holding resilient cashflow assets, which can help preserve capital value if inflation pressures persist.

An outlook for 2026 is incomplete without considering AI. After rising sharply in prominence during 2025, AI is set to remain a major global theme this year. Much of last year’s momentum was driven by largescale capital expenditure announcements rather than realised earnings, leaving parts of the market exposed to valuation and concentration risks. Even so, the current macro and policy backdrop is more supportive than in earlier periods of speculative enthusiasm, and the next phase of the AI cycle appears likely to broaden. Consensus forecasts point to another year of solid semiconductor demand and continued growth in datacentre capacity as adoption extends across industries. Elevated valuations in some AI linked segments may still generate periods of volatility.

At the same time, a broader capex upswing is emerging, supported by substantial investment in AI infrastructure and a further lift in defence spending. This should help cushion some of the pressure created by a more fragmented global trading environment. In this setting, more durable equity opportunities are likely to sit with companies that incorporate AI into their core operations as a practical driver of efficiency and process improvement, rather than those relying on AI as a thematic catalyst. These “adapters” are less reliant on turning large upfront investment into immediate earnings. That leaves them better positioned in an environment where capital needs are rising and payoff periods are lengthening.

Disclaimer

This report has been prepared for general informational purposes only and does not constitute personal financial advice. It does not take into account your specific objectives, financial situation, or needs. Before acting on any information in this report, you should consider its appropriateness in light of your circumstances and seek independent financial advice. The author holds, or may hold, positions in some of the securities mentioned in this report. These holdings may represent a potential conflict of interest. No representation or warranty is made as to the accuracy, completeness, or reliability of the information contained herein. Past performance is not a reliable indicator of future performance.