International equities

Global equities continued to rally in January, although the month was marked by a fresh wave of uncertainty driven by geopolitical tensions and new US tariff threats. A key feature of the month was the broadening of the rally across geographies, sectors and investment styles. Large US technology firms had dominated market performance for much of 2025, but that leadership began to weaken late in the year as investors questioned whether the enormous spending on AI would translate into meaningful returns. This shift sharpened on 28 January, when Microsoft fell sharply in after‑hours trading and then dropped 10% on 29 January after cloud revenue disappointed and spending tied to its OpenAI alliance surged. The UBS Magnificent 7 index slipped 0.3% over the month.

The rally in global equities was led by emerging markets and Asian share markets. The Morgan Stanley Capital International (MSCI) Emerging Markets Index jumped 8.8% in January, its strongest monthly gain since November 2022. By comparison, the MSCI World Index rose 2.2% over the month. Within the region, Hong Kong’s Hang Seng Index and Japan’s Nikkei 225 were standout performers, rising 6.9% and 5.9% respectively.

Small caps also outperformed in January. The Russell 2000 Index rose 5.3% over the month, compared with a 1.0% gain in the large‑cap Russell 1000 Index.

Another notable theme was the “sell America” trade, which gathered momentum following fresh US tariff threats and rising geopolitical risks. US long‑dated bonds sold off, the USD weakened and US equities underperformed most other major markets.

Concerns about US dollar debasement were particularly prominent, helping to propel the spot gold price to a record high of US$5,451 per troy ounce on 29 January and contributing to a USD decline not seen since early 2022. Gold’s rally in January was remarkable, surging 29.5% from its end-December-2025 close to its late‑January peak.

Investors had become increasingly concerned about the political pressure being placed on the US Federal Reserve. The Fed left the funds rate unchanged at 3.50-3.75% in January. On the final day of the month, US President Trump announced he would nominate Kevin Warsh as the next Federal Reserve Chair to replace Jerome Powell, whose term expires in May. Markets breathed a collective sigh of relief at the news. Warsh brings considerable experience as a former Federal Reserve Governor. He has historically been critical of quantitative easing and was generally viewed as a monetary policy “hawk,” although his recent comments have taken on a more pro‑growth tone. The upshot is that he is still likely to treat inflation targeting as a priority and is a less radical choice than some of the other candidates under consideration. Gold fell sharply following the announcement, dropping 8.9% on 30 January.

A review of January would not be complete without a special mention of Japan. The country faced one of its most turbulent political periods in years with the fallout extending into currency markets and global bonds. Prime Minister Takaichi unexpectedly dissolved the Lower House on 23 January and called a snap election for 8 February, seeking to capitalise on her high approval ratings and reshape the political landscape. The early election combined with sizeable campaign spending promises, intensified concerns about Japan’s fiscal credibility. At the same time, the Bank of Japan (BoJ) left its policy rate unchanged at 0.75% and upgraded its economic outlook, prompting fears that the BoJ may be falling behind the curve in addressing inflation. These developments contributed to a strong uplift in Japanese equities over the month.

Australian equities

Australian equities delivered a solid return of 1.7% in January, supported by strong gains in the energy and materials sectors. Energy was the standout performer, rising 11.1% over the month, buoyed by higher global oil prices. West Texas Intermediate crude closed January 13.5% higher, the sharpest monthly gain since July 2023.

Geopolitical shocks involving Venezuela and Iran injected significant volatility into global oil markets and pushed oil prices higher. In Venezuela, the US military’s seizure of President Nicolás Maduro on 3 January and subsequent moves to take control of the country’s oil revenues raised the prospect of a severe collapse in output. At the same time, Iran was experiencing its largest domestic unrest in decades, triggered by a currency collapse, sanctions pressures and a nationwide crackdown. These developments fuelled concerns that Tehran could restrict oil exports or even threaten the critical Strait of Hormuz, adding to fears of supply disruption.

Five of the eleven Australian sectors recorded gains in January. Health care was among the standouts after having languished late last year. In contrast, the information technology sector lost further ground and was the weakest performer in December, declining by 9.2%.

Local market returns were also affected by the appreciation of the AUD over the month. A broad-based sell‑off in the USD and rising rate‑hike expectations pushed the AUD to a near three‑year high of 0.7094 on 29 January. This stronger currency weighed on parts of the equity market, particularly given that some of Australia’s top 50 listed companies, including Macquarie, Brambles, CSL, James Hardie and Amcor, generate a large share of their earnings offshore.

|

|

Fixed income and currencies

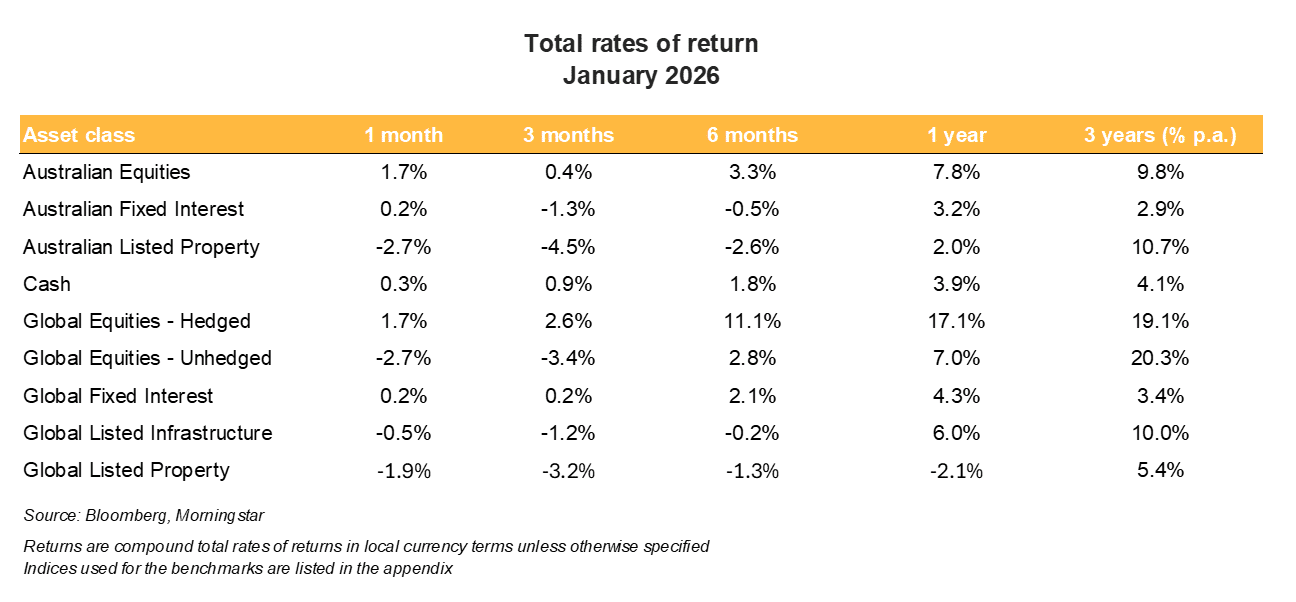

Bonds contributed only modestly to portfolio returns in January. Australian fixed interest delivered a return of 0.2% and global fixed interest also returned 0.2% over the month. Fixed income markets struggled against a backdrop of economic data that was generally stronger than expected. For example, while US payrolls data appeared soft, layoffs remained low, keeping the unemployment rate subdued. Ongoing concerns about high public spending and political pressure on the US Federal Reserve also kept long‑dated US bond yields elevated.

Stealing the limelight in January were Japan’s bond and currency markets. Yields on longer‑dated Japanese government bonds rose sharply after the government dissolved parliament and renewed spending plans heightened concerns about Japan’s fiscal position. At the same time, the BoJ’s decision not to raise rates fuelled worries that policymakers may struggle to contain inflation. Core inflation (excluding food and energy) rose 2.9% over the year to December, which was slightly lower than the previous 3.0% outcome, but still well above the BoJ’s 2% target.

Against this backdrop, over January, the 2‑year Japanese bond yield climbed 8 basis points and the 10‑year yield surged 19 basis points. On 20 January, the 10‑year yield closed at 2.35%, its highest level in nearly 27 years. The 30‑year yield also spiked, rising 23 basis points to finish at a record 3.86% on the same day, based on publicly available data that extend back to 1999.

Connected to the sharp sell‑off in Japanese bonds was a corresponding decline in the yen (JPY). The currency depreciated heavily in January, prompting foreign‑exchange intervention by authorities as USD/JPY approached the 160 level. USD/JPY fell 1.93 points over the month and experienced particularly sharp moves on 23 January after the BoJ left policy on hold, reaching an intraday high of 159.23. By 27 January, the pair had dropped rapidly by 4.5% to 152.10, amid suspected coordinated intervention by both US and Japanese authorities.

The USD index weakened over January, reflecting the sell America and debasement trade referred to in the global equities section of this report. The USD index fell to 98.55 on 28 January, the lowest since 10 February 2022. The decline in the USD was exacerbated by comments from US President Trump that he was not concerned about the depreciation in the greenback. The sell off in the USD index propelled the AUD higher. It reached 0.7093 on 29 January, its highest value in almost 3 years, also supported by higher-than-expected inflation data in Australia on 28 January.

Higher-than-expected inflation data and a lower‑than‑forecast unemployment rate pushed bond yields higher across the Australian yield curve in January, contributing to a flattening of the 2–10‑year spread. The Australian 2‑year yield rose 15 basis points to finish the month at 4.20%, while the 10‑year yield rose 10 basis points to 4.84%. Wider Australian–US bond spreads also supported demand for the AUD and meant that, in unhedged terms, global equity returns underperformed those of hedged exposures.

The Australian trade‑weighted index (TWI), which measures the value of the AUD against a basket of currencies weighted by Australia’s trade patterns, rose almost 8% in January and may help dampen inflationary pressures. With the RBA delivering a rate hike in February and signalling that further tightening is likely, the extent of any additional increases will in part depend on how the TWI evolves. A stronger TWI, by easing imported inflation, could reduce the need for more aggressive policy action.

US Treasury yields also rose across the curve in January. The sell‑off in Treasuries, reflected in higher yields, was most pronounced at the shorter end after theUS Federal Reserve left the funds rate unchanged and Chair Powell signalled that policy would remain on hold for an extended period. This move was reinforced by macroeconomic data, including a low US unemployment rate, which pointed to ongoing resilience in economic conditions. Interest‑rate markets subsequently pushed out expectations for the next rate cut, with markets now fully pricing the first cut for July 2026, compared with June 2026 previously.

European bond markets outperformed most other major markets. Government bonds in Germany and France rallied, while UK gilts only sold off modestly at the long end of the curve.

Property and infrastructure

Australian listed property and global listed property (in unhedged AUD terms) both posted negative returns in January of -2.7% and -0.9%, respectively. Rising bond yields were the main headwind, as higher discount rates weighed on the valuation‑sensitive-real-estate-investment trust (REIT) sector. In Australia, A‑REITs slipped through the month as the jump in local yields and ongoing uncertainty around the timing of RBA policy tightening pressured the sector. Globally, listed real-estate performed better in local‑currency terms, for example, the widely-watched ‘FTSE EPRA Nareit Developed’ series. But those gains were eroded for Australian investors by a sharp fall in the USD and a strong rally in the AUD. Currency moves, alongside rising sovereign yields in major markets, compounded the drag on unhedged returns and left both domestic and international listed property lagging broader equity markets in January.

Global infrastructure also delivered a negative return of 0.5% in January. The sector came under pressure from the rise in global bond yields, which weighed on valuation‑sensitive, income‑oriented assets. While underlying cash flows from essential services such as utilities, transport networks and energy infrastructure remained stable, the increase in discount rates offset these fundamentals. Longer‑term structural themes, such as growing demand for renewable energy, power networks and digital infrastructure will continue to provide some support to global infrastructure.

Economic outlook

Global share markets started 2026 on a stronger and more balanced footing. Gains are no longer coming from just a handful of big US tech companies, instead, a wider mix of markets such as emerging economies, Japan, and smaller companies have been pulling their weight. However, uncertainty is high and fresh waves of geopolitical risks have occurred.

In Australia, the RBA’s quick shift from cutting rates last year to raising rates again in early 2026 shows that inflation is proving harder to tame. The Bank now expects inflation to stay above its 2–3% target for longer, so more rate hikes remain firmly on the table. For households and investors, this means looking beyond headline returns and focusing on whether investments are keeping ahead of inflation.

Given this backdrop, value-style Australian shares, such as banks, energy and resources companies, are likely to outperform growth stocks. These companies generally have stronger pricing power and benefit more from higher inflation and higher interest rates, while growth stocks can struggle when borrowing costs rise.

Overall, the rapid shifts in inflation, interest rates and geopolitics reinforce the need for diversified portfolios. Spreading investments across different countries, industries and investment styles is the best way to manage volatility and protect purchasing power through 2026. Bonds still play a role in stabilising portfolios even though recent returns have been soft.

Disclaimer

This report has been prepared for general informational purposes only and does not constitute personal financial advice. It does not take into account your specific objectives, financial situation, or needs. Before acting on any information in this report, you should consider its appropriateness in light of your circumstances and seek independent financial advice. The author holds, or may hold, positions in some of the securities mentioned in this report. These holdings may represent a potential conflict of interest. No representation or warranty is made as to the accuracy, completeness, or reliability of the information contained herein. Past performance is not a reliable indicator of future performance.