International equities

Most major global share markets finished lower in November, after a strong run since the start of the year. Throughout November, global investors were cautious about elevated and frothy valuations, particularly in technology-related stocks. Concerns about the sustainability of recent gains in the artificial intelligence (AI) industry were part of this theme. In fact, strong quarterly results from NVIDIA and other tech leaders failed to dispel fears of overly optimistic profit expectations.

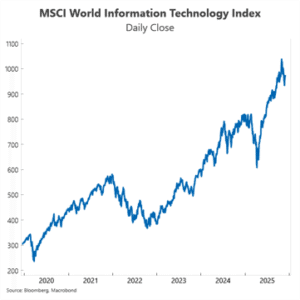

The Morgan Stanley Capital International (MSCI) World Information Technology Index fell 1.1% in November, marking its first decline in eight months. Markets with substantial technology exposure, including several Asian benchmarks, recorded sharp losses. The Nikkei 225 index posted a return of -4.1% and the Shanghai-Shenzhen CSI 300 a return of -2.4%.

Volatility was high with the US benchmark S&P 500 losing 4.6% from the start of November through to 20 November, before the index finished the month up just 0.1%. A reassessment of the US interest rate outlook affected US equities, which also flowed through to sentiment in other markets. The US Federal Reserve cut the federal funds rate by 25 basis points at its October meeting. But at its November 7–8 meeting, US Federal Reserve Chair Powell held rates steady and warned that another cut in December 2025 was far from assured, surprising markets and contributing to additional volatility. Defensive stocks, such as health and consumer staples, outperformed cyclical and technology shares as investors sought stability.

The search for stability also flowed through to gold, which moved higher in November as investors turned to safe-haven assets amid heightened uncertainty. The spot price of gold ended the month 5.9% higher, leaving it 60.4% above its level a year ago.

Uncertainty related to the longest US government shutdown in history, which lasted 43 days and ended mid-month, contributed to the rotation into defensive stocks and asset classes. The lack of available US economic data and questions about the impact on growth further weighed on sentiment.

European equity indexes outperformed those in the US, supported by strong financial and IT sector earnings and a less concentrated technology weighting. The UK FTSE 100 index was among the best performers in November, finishing unchanged, with a total return of 0.4% for the month.

Over a longer time horizon of three years, global equities (unhedged) have delivered the strongest returns of any asset class.

Australian equities

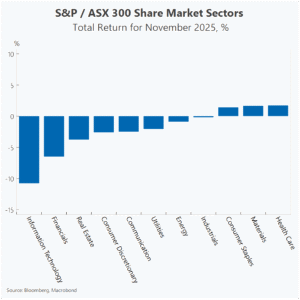

Australian equities again underperformed global equities this month. The S&P/ASX 300 index returned a loss of 2.4%, compared with a return of 0.2% for global equities (unhedged). The index peaked on 21 October, then experienced a sharp sell off, falling 7.5% by 21 November. Bargain hunters then entered, prompting a market rebound. The index rose 2.5% between 21 and 28 November.

Only three sectors posted positive returns in November: health care, materials and consumer staples. The health care sector led the gains, returning 1.7% in November. Major names such as Ramsay Health (+14.7%) and CSL (+4.4%) delivered a strong performance.

Eight of the 11 sub sectors declined in November, led by a steep drop in information technology (-10.8%). Companies with high valuations and strong earnings growth expectations were hit hard, including Life360 (-18.8%), Technology One (-17.4%), Xero (-15.6%) and NextDC (-13.9%). Wisetech Global bucked the trend, returning 5.6%. The financials sector also fell sharply (-6.2%) with heavyweight Commonwealth Bank losing 11.1%.

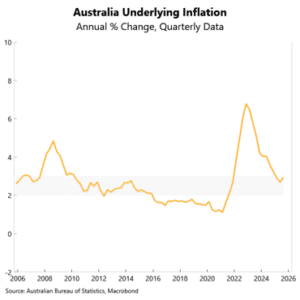

Cash-rate expectations shifted further in November towards a hike, which weighed on equities as an asset class. Quarterly inflation data released in late October was stronger than expected, ending the disinflation trend that began in late 2022.

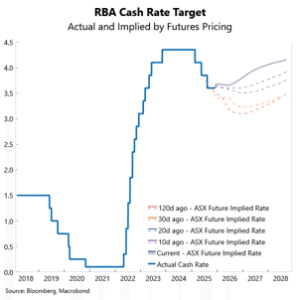

At its November 4 meeting, the Reserve Bank of Australia (RBA) left the cash rate unchanged. For the first time this year, the Board did not discuss rate cuts. Importantly, it revised its forecasts, projecting underlying inflation to rise further and return to the 2–3% target band only in the second half of 2025. Remarks from the RBA Governor suggested more rate cuts are no longer assured and, in fact, the rate-cutting cycle may be finished.

Later in November, the new monthly inflation measure heightened concerns about upside inflation risks. Headline and underlying inflation rose 3.8% and 3.3% year-on-year to October, respectively. Markets moved from expecting rate cuts in 2025 to removing those expectations entirely. By month-end, futures even implied a possible hike in 2026. At the end of November, futures priced a 41% probability of a rate hike before the end of 2026, compared with a 96% probability of a rate cut at the end of October.

|

|

Fixed income and currencies

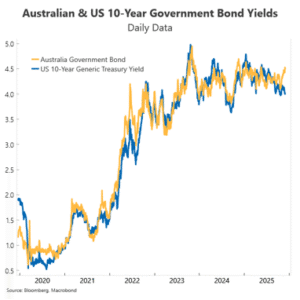

Global fixed income delivered a modest 0.2% return in November, as concerns about the US economic outlook persisted and data was disrupted by the US government shutdown until mid November. At the end of November, markets were nearly fully priced for a rate cut from the US Federal Resever in December with a further two cuts in 2026. However, expectations of increased future bond issuance in the US weighed on overall performance.

Domestically, fixed interest fell 0.9% in November as markets increasingly priced in the likelihood of a rate hike in Australia next year. Partial economic indicators pointed to a continued recovery in activity, while upside risks to inflationary pressures persisted.

Credit spreads remained low in Australia and the US, despite the uncertainty that characterises the outlook.

The US dollar index stuck to a narrow range during November and finished the month just 0.3% softer. It is 3.4% higher than the 2025 low of 96.22 recorded on 17 September, which was the weakest level since February 2022.

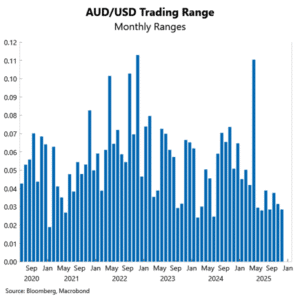

The Australian dollar traded within a relatively narrow range of 0.6421 to 0.6580 in November, reaching the upper end of the range just before the US government shutdown concluded. It posted a modest gain against the US dollar, edging up from 0.6545 at the end of October to 0.6550 at the end of November. The currency also strengthened against the Japanese yen and Swiss franc, while recording slight declines versus the euro, British pound, Canadian dollar and New Zealand dollar.

Property and infrastructure

Australian listed property underperformed in November, as market sentiment shifted amid more hawkish interest-rate expectations. Futures pricing began to signal the possibility of an RBA rate hike in 2026, reversing earlier expectations of cuts. This repricing pushed bond yields higher, reducing the relative appeal of property trusts and increasing funding costs for leveraged assets. Elevated valuations following strong gains earlier in the year added to the pressure.

National house prices continued to rise in November. The Cotality home value index increased by 1.0% in November, slightly below the 1.1% gain in October. Persistent supply shortages relative to demand will keep upward pressure on prices. However, the prospect of no further rate cuts from the RBA and stretched affordability means the pace of growth will moderate. The announcement of debt-to-income caps by the Australian Prudential Regulation Authority (APRA) at the end of November should also modestly limit price gains next year.

Economic outlook

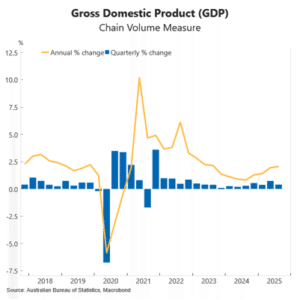

Data earlier this week revealed Australia’s economy continues to expand, though momentum has moderated. In the September quarter, GDP grew by 0.4%, following growth of 0.7% in the June quarter. Annual growth stepped up to 2.1%, around the economy’s estimated potential.

Encouragingly, the economic recovery has broadened, supported by resilient household spending focused on essentials, robust business investment (particularly in technology and infrastructure) and a rebound in public sector activity. The household savings ratio climbed to 6.4%, reflecting more cautious consumer behaviour as upside inflationary pressures emerged. With growth now near its “speed limit,” there may be little room for further expansion without risking higher prices.

Upside inflation risks remain a central concern for policymakers and are unlikely to dissipate quickly, even though some components of the recent higher inflation readings are temporary. Underlying inflation, as measured by the trimmed mean, rose 1.0% in the September quarter, lifting the annual rate to 3.0% – the top of the Reserve Bank’s target band. Underlying inflation is likely to rise further through the rest of this year and into the first half of next year before easing. Unemployment remains relatively low, although jobs growth has lost some momentum since the start of the year. Last month, we revised our outlook and now expect the RBA to keep rates on hold throughout 2026. The prospect of no further rate cuts may see the pace of economic growth wane, but we expect it will remain near the speed limit. Interest-rate markets have fluctuated in recent months; currently, a 25 basis point rate hike is fully priced for September next year. Just a month ago, markets were fully priced for a cut. Heightened uncertainty in the economy continues to make forecasting challenging.

Against this backdrop, Australian market returns in November paused after a strong run, with notable rotation beneath the surface. Growth stocks underperformed despite solid fundamentals, while defensive sectors such as healthcare and consumer staples led gains. This shift highlights the risks of relying on high valuations and optimistic growth forecasts. In this environment of heightened uncertainty, diversifying equity portfolios across regions and maintaining exposure to high-quality bonds remains important for managing risk.

Disclaimer

This report has been prepared for general informational purposes only and does not constitute personal financial advice. It does not take into account your specific objectives, financial situation, or needs. Before acting on any information in this report, you should consider its appropriateness in light of your circumstances and seek independent financial advice. No representation or warranty is made as to the accuracy, completeness, or reliability of the information contained herein. Past performance is not a reliable indicator of future performance.