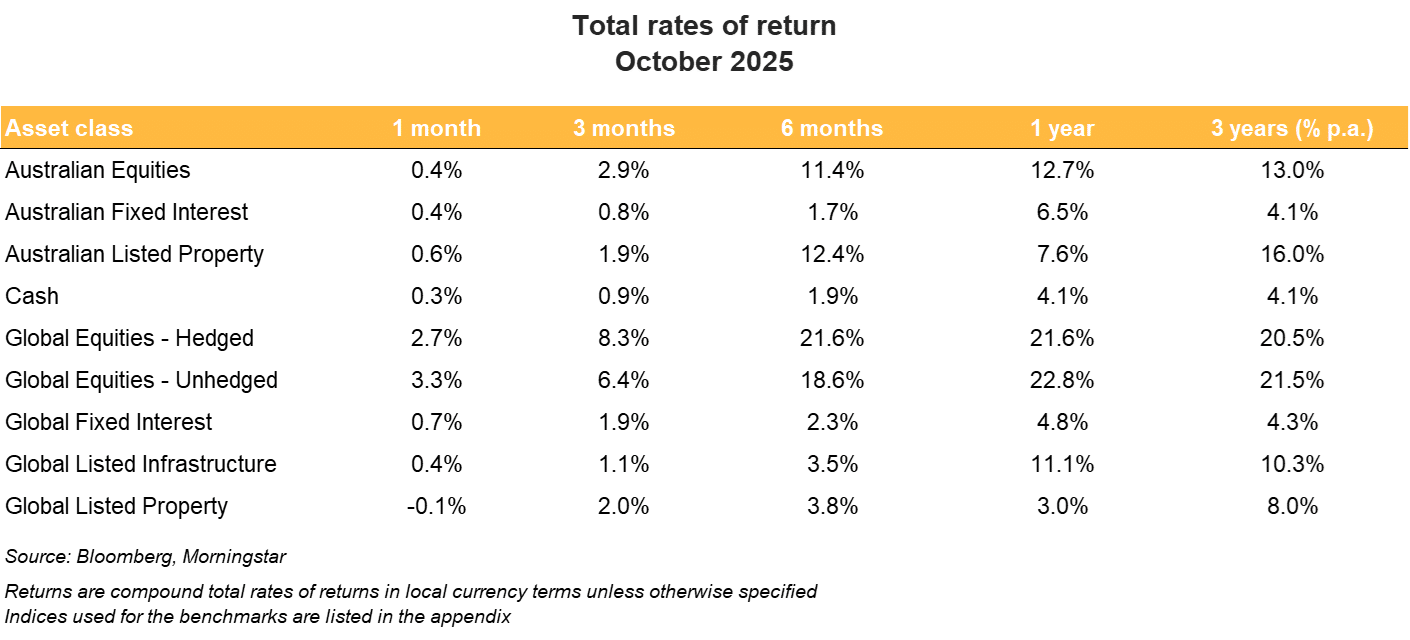

International equities

In October, both hedged and unhedged global equities recorded firm gains. Over a three-month, six-month, annual and three-year period, they have also stood out. Increasingly, market discussion is turning to how long the acceleration in major indices can last without a correction.

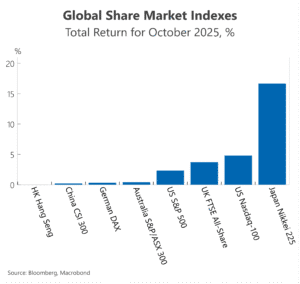

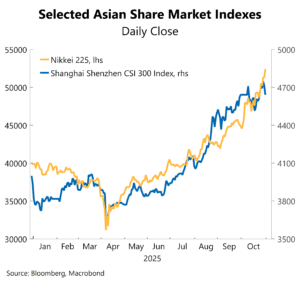

Performance was mixed across the regions. The standout performer was Japan’s Nikkei 225 index, which surged 16.6% in October. It’s biggest monthly return since January 1994 and eclipsed the performance of other major share markets. Further, it reached a new record high on 31 October. The Bank of Japan (BoJ) held monetary policy steady during the month. In October, Sanae Takaichi became Japan’s first female Prime Minister and President of the Liberal Democratic Party (LDP). Takaichi is long known as an avid supporter of “Abenomics”. Hopes of economic stimulus via expanding fiscal policy boosted sentiment in Japanese equities, as did a weaker Japanese currency.

In China, trade was again in the spotlight after a resurgence in trade tensions with the US sparked by remarks from US President Trump. On 10 October, the US S&P 500 dropped 2.7% – its biggest one-day decline since the Liberation Day announcement in April. On 30 October, President Trump and China’s President Xi Jinping met in South Korea and struck a one-year deal where China suspended its rare earths and critical minerals export controls and ended probes of US chip companies, while the US cut fentanyl tariffs and paused certain technology restrictions. The discussions eased trade tensions, although a formal agreement was not reached. By the end of October, China’s share market delivered a return of 0.2%, after a rapid clip in September of 3.3%. Amid the resurgence in trade tensions, demand for gold, a safe-haven asset, was boosted.

US equities in October were bolstered by expectations of another rate cut by the US Federal Reserve on 30 October. Indeed, the S&P 500 and Nasdaq 100 indices hit new record highs on 28 and 29 October, respectively, in the lead up to the decision. The Fed delivered with a 25-basis-point cut, taking the federal funds rate to 3.75%-4.00%. However, the key surprise came in the press conference when Federal Reserve Chair Jerome Powell warned that a December rate cut was far from a done deal. Markets interpreted this as a signal that the Fed may pause in December and are currently anticipating three more rate cuts before the end of 2026. The US government shutdown dragged on through October and disrupted the publication of economic data. However, financial markets largely shrugged off the impact. Another solid US corporate earnings season lent support. According to J.P.Morgan, at the end of October, 320 companies (71% of market capitalisation) had reported with 82% beating consensus expectations.

US mega-cap technology stocks continued to benefit from strong demand for AI-related equities, with the ‘Magnificent 7’ tech giants jumping 4.9% in October, after adding 9.0% in September.

Across the Atlantic, the UK’s FTSE 100 also hit a record high on 31 October. However, other European bourses had mixed performances; the German DAX rose modestly while the French CAC 40 contracted. The European Central Bank (ECB) left its key interest rates unchanged on 30 October. There are growing signs that the ECB’s easing cycle may be over or close to being done.

Finally, in emerging markets, the victory of President Javier Milei’s party in Argentina’s mid-term election propelled the MSCI emerging index up 4.1% in October. In comparison, the developed market index rose 1.9% over the same time period.

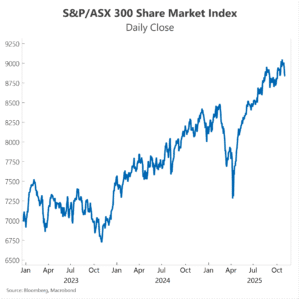

Australian equities

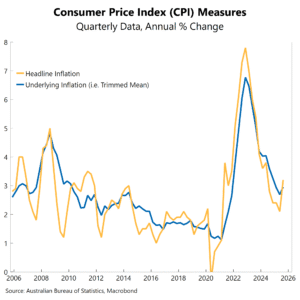

In October, the Australian share market underperformed international peers again. The S&P/ASX 300 index returned 0.4%, compared with a return in global equities (unhedged) of 3.3%. A high monthly inflation result for August, published at the end of September, pointed to upside risks in the quarterly inflation data closely watched by the RBA. The result suggested the RBA may not ease policy at its next board meeting in November. Remarks after the September board meeting by the RBA Governor added to this sentiment and tempered gains in the share market during October.

The S&P/ASX 300 index hit a new record high of 9,048 on 21 October following another soft jobs report on 16 October that showed a rise in the unemployment rate to a near-four-year high of 4.5%. The jobs report kept alive the possibility of a near-term rate cut, pending the release of inflation data on 29 October.

|

|

On 29 October, the underlying (trimmed mean) measure rose 1.0% in the September quarter, well above consensus and most estimates. The annual rate accelerated to 3.0%, the top of the Reserve Bank’s (RBA’s) 2–3% inflation target band, representing the first increase in the year-on-year rate since inflation peaked almost three years ago. The strong inflation outcome cemented expectations that the RBA would remain on hold for some time. Markets started to factor in the chance that this cycle may see no further rate cuts. The index lost nearly 2% from the time of the quarterly inflation release to the end of the month.

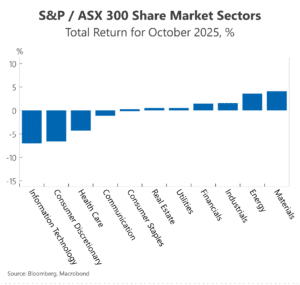

Across the sectors, seven of 11 sectors delivered higher total returns in October. The strongest sector was materials, returning 4.1% in the month. Within materials, an improvement in the fundamental outlook for lithium prices due to tightening supply helped lithium producers rally. A surge in the spot price of gold to a new record high of US$4,381.52 a troy ounce on 21 October also bolstered gold-producer stocks. Gold at the end of October had jumped 51.4% on a year ago. In addition, helping shares in this sector was the signing of a landmark bilateral framework between the US and Australia on critical minerals and rare earths. The deal involves an $8.5 billion pipeline of priority projects; both countries have committed to at least $1 billion each in investments within six months.

|

|

The weakest sector was information technology. Wisetech Global experienced the sharpest sell off in this sector after the Australian Securities and Investments Commission (ASIC) and Australian Federal Police raided the company’s Sydney office on 28 October. Its share price plunged almost 18% on this date and ended the month nearly 24% lower. Household name Xero also sold off sharply, stemming from ongoing investor concerns about its massive US$2.5 billion acquisition of Melio.

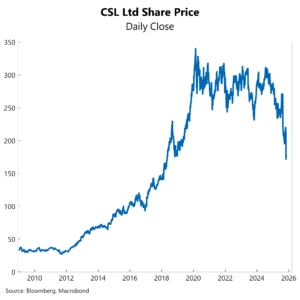

CSL dominated headlines in October as its share price tumbled after the company cut its outlook at the annual general meeting. A big driver of the weaker outlook is CSL’s vaccine arm, Seqirus, which is facing a sharp decline in US influenza vaccine rates. CSL had previously planned to spin off Seqirus and list by mid 2026. These plans have been shelved for now. The share price sold off 24.5% from its high during the month of $222.47 on17 October to $167.99 on 29 October. This was the lowest share price since May 2018. It remains only slightly above that level today.

Fixed income and currencies

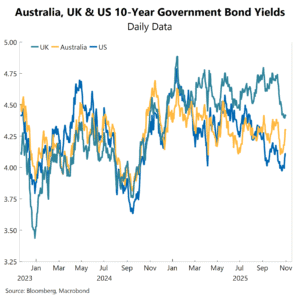

Global fixed interest delivered a return of 0.7% in October, while Australian fixed interest produced a total return of 0.4%. Australian fixed interest returns were tempered by expectations of the RBA entering an extended pause and possibly completing its easing cycle. The Federal Reserve sent a warning that another rate cut this year in December was far from assured, but the market stil has three more rate cuts priced by the Fed before the end of 2026. In comparison, today rate markets are pricing in a probability of 93% of just one more RBA easing in the second half of next year.

UK gilts were the standout among developed government bond markets last month. The UK 10-year government bond yield declined by 29 basis points in the month, as markets shortened the odds of rate cuts next year. In comparison, yields declined in New Zealand (-13bp), the US (-8bp), Germany (-8bp) and Canada (-6bp). Longer-dated yields rose in Japan, as markets anticipate a further tightening in monetary policy and were relatively steady in Australia.

Credit spreads widened in Australia, as measured by the 5-year iTraxx index. Despite the modest widening, credit spreads remain low. In US credit markets, spreads ended October largely unchanged from the end of September. Despite heightened uncertainty about the outlook, these spreads also remain historically low.

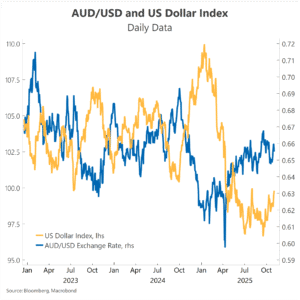

The US dollar index appreciated 2.0% in October, led by a sharp rise against the Japanese yen. The index ended October at 99.80, which is its highest since early August and 3.8% above the low of 96.22 reached on 17 September (the weakest level since February 2022).

The Australian dollar depreciated modestly against the US dollar in October, closing at 0.6440 compared with the September month-end close of 0.6613. The month’s high of 0.6629 was struck early in the month, while the low of 0.6440 occurred on 14 October.

Property and infrastructure

Australian listed property delivered a moderate return of 0.6% in October, supported by rising dwelling prices nationally, particularly in Perth, Brisbane and Darwin. Demand for residential property strengthened, driven by three rate cuts earlier this year and an ongoing housing shortage. Building approvals are recovering, but demand continues to outpace supply, pushing prices higher. According to Cotality, national home values rose 1.1% to a record median value in October, the strongest monthly gain since mid 2023. Changes to the First Deposit Scheme, effective from 1 October, also boosted first-home buyer activity. While these factors underpinned performance, an extended pause by the RBA and stretched housing affordability may temper momentum in coming months. Over the past six months, Australian listed property has delivered a total return of 12.4%, outperforming Australian equities, cash and fixed interest.

In contrast, global listed property posted a marginal decline of 0.1% in October, following a fall in September. Performance was mixed across regions, with Asia-Pacific markets outperforming while Europe weakened.

Over the past year, global listed property has gained 3.0%, compared with a 7.6% increase for Australian listed property, highlighting the relative resilience of domestic real-estate-investment trusts (REITs) amid supportive housing dynamics.

Global listed infrastructure delivered a return of 0.4% in October and over the past year delivered 11.1%, underpinned by steady demand for defensive assets amid heightened global macroeconomic uncertainty. Transport infrastructure, including toll roads and airports, benefited from resilient traffic volumes and improving travel trends, while utilities and energy infrastructure saw gains amid ongoing investment in renewable projects.

Economic outlook

Recent data indicate stronger inflationary pressures in Australia than previously expected, with underlying inflation rising to 3% in the September quarter. While part of this increase may prove temporary, capacity constraints and firm demand suggest price pressures will persist longer than anticipated. The labour market has softened slightly, but indicators such as vacancy ratios and unit labour costs point to ongoing tightness.

Against this backdrop, the Reserve Bank left the cash rate unchanged at 3.60% on 4 November and signalled caution. With earlier policy easing still filtering through and inflation proving sticky, the Board is expected to remain data-dependent and responsive to evolving risks. We have retained one more rate cut in this cycle in our forecasts with a timing of Q3 2026. However, we hold this view with a low conviction and no further rate cuts in this cycle remains a distinct possibility.

Risk premiums and volatility in markets remain low. In contrast, measures of global economic uncertainty remain heightened. Financial markets appear to be focussing on the good news. Consequently, there is a risk that unexpected outcomes could prompt an outbreak of volatility and a correction in equity prices and/or a widening in corporate bond spreads.

Disclaimer

This report has been prepared for general informational purposes only and does not constitute personal financial advice. It does not take into account your specific objectives, financial situation, or needs. Before acting on any information in this report, you should consider its appropriateness in light of your circumstances and seek independent financial advice. No representation or warranty is made as to the accuracy, completeness, or reliability of the information contained herein. Past performance is not a reliable indicator of future performance.