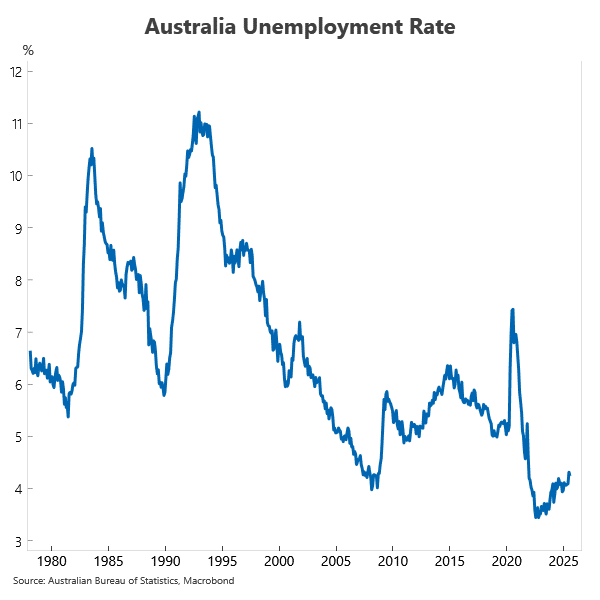

Australia’s labour market remains resilient and tight. Jobs jumped by a healthy 24.5k in July, after a loss of 2k jobs in the previous two months. The improvement in jobs helped the unemployment rate edge down to 4.2% in July, from 4.3% in June. This is not far from 3.4%, which was recorded in late 2022 and represented the trough in the economic cycle.

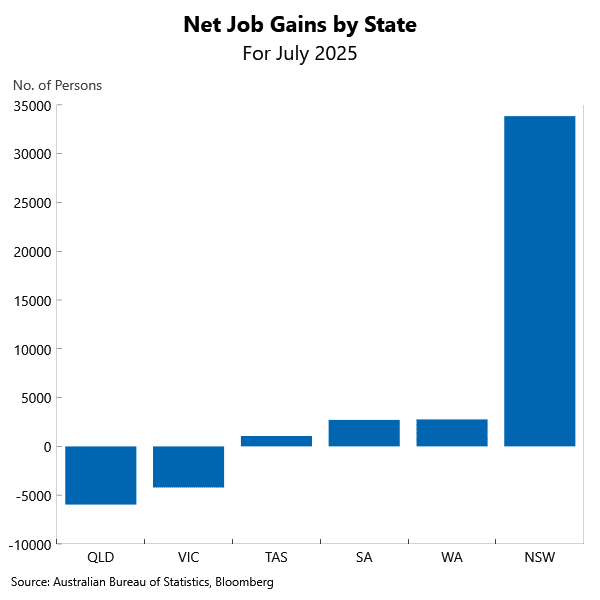

NSW drove the month’s gains, adding nearly 34k jobs, which is the largest rise in eight months for the state and reverses a loss of 45.2k over the previous two months. NSW’s unemployment rate fell to 4.0% and Victoria retained its position of having the highest unemployment rate of 4.6%.

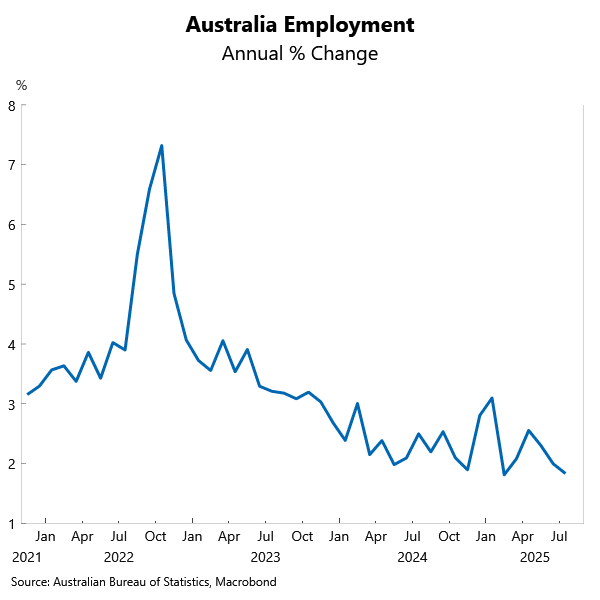

Despite the set of strong numbers for July, the momentum in the jobs markets appears to be showing some early, modest signs of easing. Over the year to July, the economy has added nearly 264k jobs, down from more than 400k in January. Annual employment growth has slowed to 1.8% in July, from 2.6% in April and the employment-to-population ratio has slipped 0.6 percentage points in the past two months to 64.1%.

Our business liaison with recruitment contacts suggests a subtle shift underway in hiring dynamics. Employers are becoming more selective when hiring by focusing on closer skill matches.

This is occurring against a backdrop of a sluggish economic growth. Growth is improving but slowly and remains below the long-run trend. The Reserve Bank’s updated forecasts this week downgraded growth for this year and next, signalling a slower recovery than previously anticipated. The weaker recovery means demand for labour may decline.

Attention is also on the structural change from AI with concerns that adoption is set to trigger widespread job losses. It’s likely that as with past structural shifts and technological change, new jobs not yet imagined will emerge as the economy adapts. For example, a decade ago, ‘influencer’ was barely a recognised job.

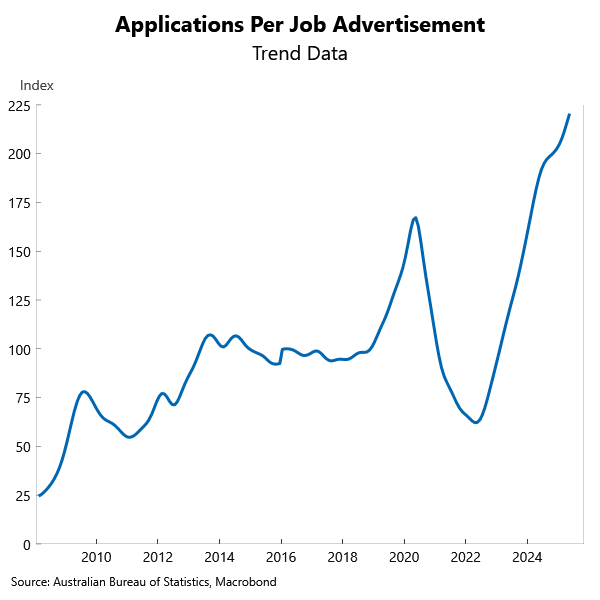

One obvious change AI is causing is it is altering patterns in job applications, which is complicating the interpretation of forward-looking indicators such as the number of applications per job vacancy. Automated tools now allow candidates to apply for multiple roles quickly and at low effort, driving a sharp increase in applications per job. It remains unclear how much of this surge reflects a genuine, emerging softening in labour demand versus the impact of AI-driven application activity.

Industry breakdowns were not released with the latest jobs data, but as of the latest available data in May, the strongest gains have been in health – a sector benefiting from heavy government support and demographic trends, including population growth and ageing.

On the outlook for the cash rate, today’s data does not change our view. The Reserve Bank expects the unemployment rate to average 4.3% in the September quarter and with two more months to complete the quarter, there’s no convincing reason to change our forecast.

Our base case remains two more rate cuts from the Reserve Bank – in November 2025 and February 2026. However, we continue to flag the risk of a third cut due to the cautious approach from the central bank in cutting rates. On unemployment, we expect the rate to tick higher towards 4.5% by mid next year, before improving.

The information in this article is general in nature, intended for informational purposes only and does not constitute financial, investment, legal or professional advice; readers should seek guidance from qualified professionals before making decisions based on its content.