The Reserve Bank (RBA) has surprised markets and economists alike by leaving the cash rate unchanged today at 3.85%. Financial markets had over a 90% probability attached to a cut and in a recent Bloomberg poll, only 5 economists out of 32 expected rates to remain unchanged.

The decision was not unanimous by the RBA Board. For the first time, the RBA disclosed a split vote among its board members, with six favouring the hold and three advocating for a cut.

The statement points to a cautious and patient RBA, opting to hold fire until the 30 July quarterly inflation report confirms that inflation is slowing as expected. Governor Bullock reinforced this in her press conference, suggesting the Board wants to be sure they have ‘nailed’ inflation before moving.

Michele Bullock repeatedly emphasised that it’s not about the direction of rates, but the timing. She noted the RBA Board is taking a cautious and gradual approach. In that context, a quarterly inflation report that aligns with the Bank’s forecasts should clear the way for a rate cut in August. While the RBA already has monthly inflation data for April and May, with June still to come, they don’t appear to see it as a reliable signal. The RBA Governor said in the press conference she does not believe the inflation rate is as low as what the monthly measure is suggesting.

We remain surprised by the RBA’s decision to hold, given the challenging economic backdrop. While patience is generally a virtue, there are times when it can hinder progress.

Globally, uncertainty remains high and persistent. While Governor Bullock noted that severe downside scenarios have abated, she acknowledged conditions remain fluid. That fluidity was on display overnight when US President Trump revived his threats of steep ‘reciprocal’ tariffs. Letters have been sent to more than a dozen countries with levies set to begin on 1 August. Notably, four nations receiving letters — Japan, South Korea, Malaysia and Thailand — are among Australia’s largest trading partners. These tariffs at least match the scale of those imposed on Liberation Day. The 10% universal tariff also remains in place, along with numerous sectoral levies. The post-Trump world is still one of elevated trade barriers.

Some may expect Trump to walk back the tariffs again — a pattern that has earned him the label ‘Trump Always Chickens Out (TACO)’. However, the unpredictability is still damaging. Businesses need certainty. Ongoing trade and supply chain uncertainty are stalling investment. While US economic data has held up so far, cracks are emerging. The September quarter is likely to show the true impact of tariffs, as earlier stockpiling by firms and households runs down. Private sector employment has started to soften and consumer confidence remains weak.

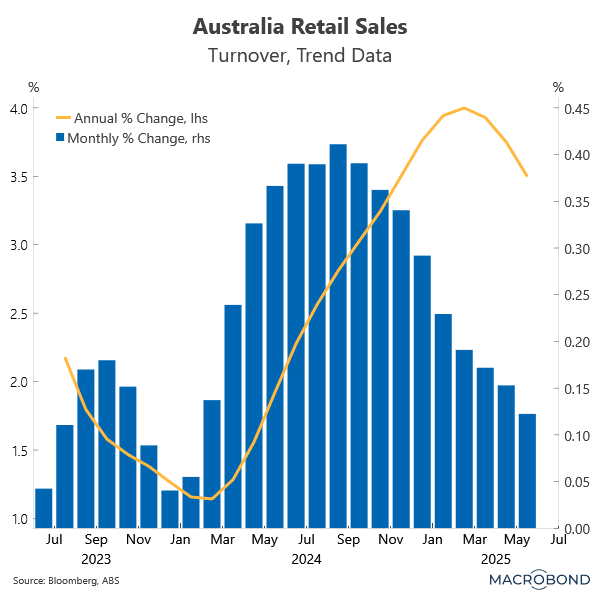

Domestically, the RBA is weighing subdued consumer spending against a resilient labour market and persistently weak productivity growth. It also flagged uncertainty around monetary policy lags — still long and variable. Retail turnover has been soft for five straight months, and consumer sentiment remains deeply pessimistic. A robust, sustained recovery still feels a long way off.

One of our key concerns is the weakening in business spending plans. The recovery in private sector demand is shaky, even as government spending props up overall activity. The Governor pointed to a bounce in business confidence reported earlier today, but it does not reflect what we’re hearing on the ground at William Buck.

So, what’s next?

All eyes now turn to Thursday’s jobs report and the crucial quarterly inflation print on 30 July. Markets are pricing in an 80% chance of an August cut, with another likely in November — a quarterly rhythm that fits the RBA’s preference to move in step with inflation data.

We had originally forecast cuts in July, August, and November. We now shift to expecting just two more this year — August and November — in line with the RBA’s cautious, incremental approach.

The risk is that the RBA’s cautious approach delays the recovery from gaining traction — potentially requiring more rate cuts next year.

The next key event is Governor Bullock’s speech at the Australian Business Economists’ annual fundraiser for the Anika Foundation on 24 July. This address will be closely watched for any clues on the near-term outlook.

| Increase in house prices since rate cuts began in Feb 2025 | |

| Darwin | 6.1% |

| Brisbane | 2.4% |

| Perth | 2.4% |

| National | 2.0% |

| Melbourne | 1.8% |

| Sydney | 1.7% |

| Adelaide | 1.7% |

| Canberra | 1.5% |

| Hobart | 1.1% |

| Source: Cotalityhousingdata | |

Finally, on housing — always a lightning rod. Prices should continue to rise. Affordability has improved since the February and May rate cuts, but only modestly. Affordability receives no lift today. National dwelling prices are up 2.0% since the easing cycle began and we expect gains of around 5% over 2025, underpinned by ongoing supply constraints.

The information in this article is general in nature, intended for informational purposes only and does not constitute financial, investment, legal or professional advice; readers should seek guidance from qualified professionals before making decisions based on its content.