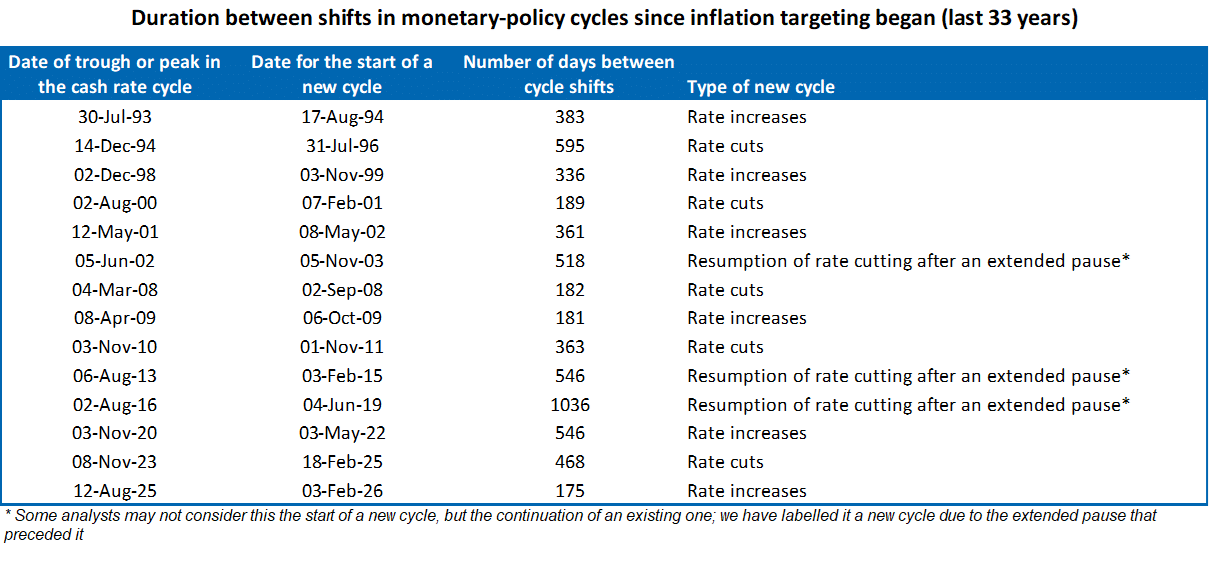

The RBA made history today. It increased the cash rate by 25 basis points to 3.85%, marking the shortest break between cycles since inflation targeting began 33 years ago in 1993. The RBA remained on hold for only 175 days. It also brings to a close the rate cutting cycle that began in February last year and ended in August. That phase was the shortest and shallowest since at least 1993.

A material pick up in inflation emerged in the second half of 2025, as private and public demand pushed against available capacity. Some of the strength in demand from late 2025 has continued into 2026 and the economy is now judged to be more supply constrained than earlier assessed. Household spending and business investment strengthened over this period and price increases were concentrated in housing, durable goods and market services. These capacity pressures and the renewed momentum in demand have led the RBA to expect a slower return to the inflation target.

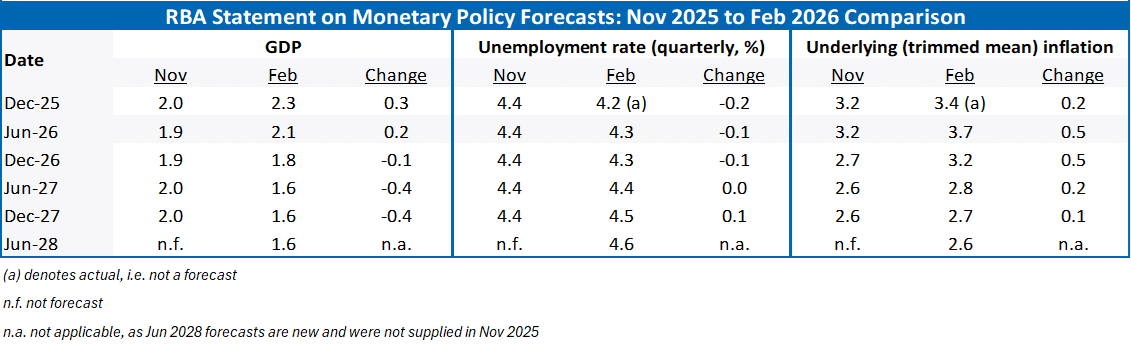

The RBA’s latest forecasts in the quarterly Statement on Monetary Policy show a broad upward revision to underlying trimmed mean inflation across the entire forecast period. The underlying annual inflation rate is now expected to reach 3.7% in June 2026, compared with the earlier projection in November 2025 of 3.2%. It does not return to the target range until mid 2027 and does not reach the 2.5% midpoint at any point in the forecast horizon.

The unemployment rate has been revised lower for this year and slightly higher for 2027. Near term economic growth has been lifted and is expected to move further beyond the potential growth rate until the second half of this year. The challenge for the RBA is that the potential growth rate sits around 2%, which is lower than in the past due to subdued productivity growth. A prominent adjustment in the outlook is the stronger forecast for business investment through 2026.

There’s some uncertainty about how much of the lift in inflation is temporary and how much of it isn’t. The RBA Governor in the press conference said she’s giving some weight to each and has flagged it may have to raise rates further. However, when she was explicitly asked if this is the start of a tightening cycle, the Governor said, “I don’t know,” adding that today’s decision is an adjustment.

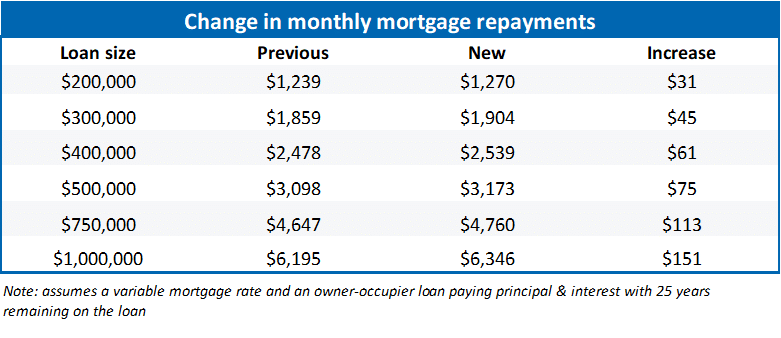

We do not see today’s move as one-and-done and continue to expect another rate hike in the first half of this year. We also would not fully rule out the possibility of three rate hikes materialising in 2026. A Reuters poll published last week showed 10 (including us) of 24 Economists expect another rate hike before the end of this year. While it is less than half, households, especially those with mortgages, need to mindful of the risks of further tightening. One factor that will assist the inflation outlook is the appreciation in the Australian dollar. We expect the AUD/USD to move to 0.7300 by the end of June and 0.7500 by the end of this year, as the US dollar remains weak and the risk of more tightening from the RBA remains live. In trade-rated terms, the Australian dollar has already moved almost 8% higher since the end of last year.