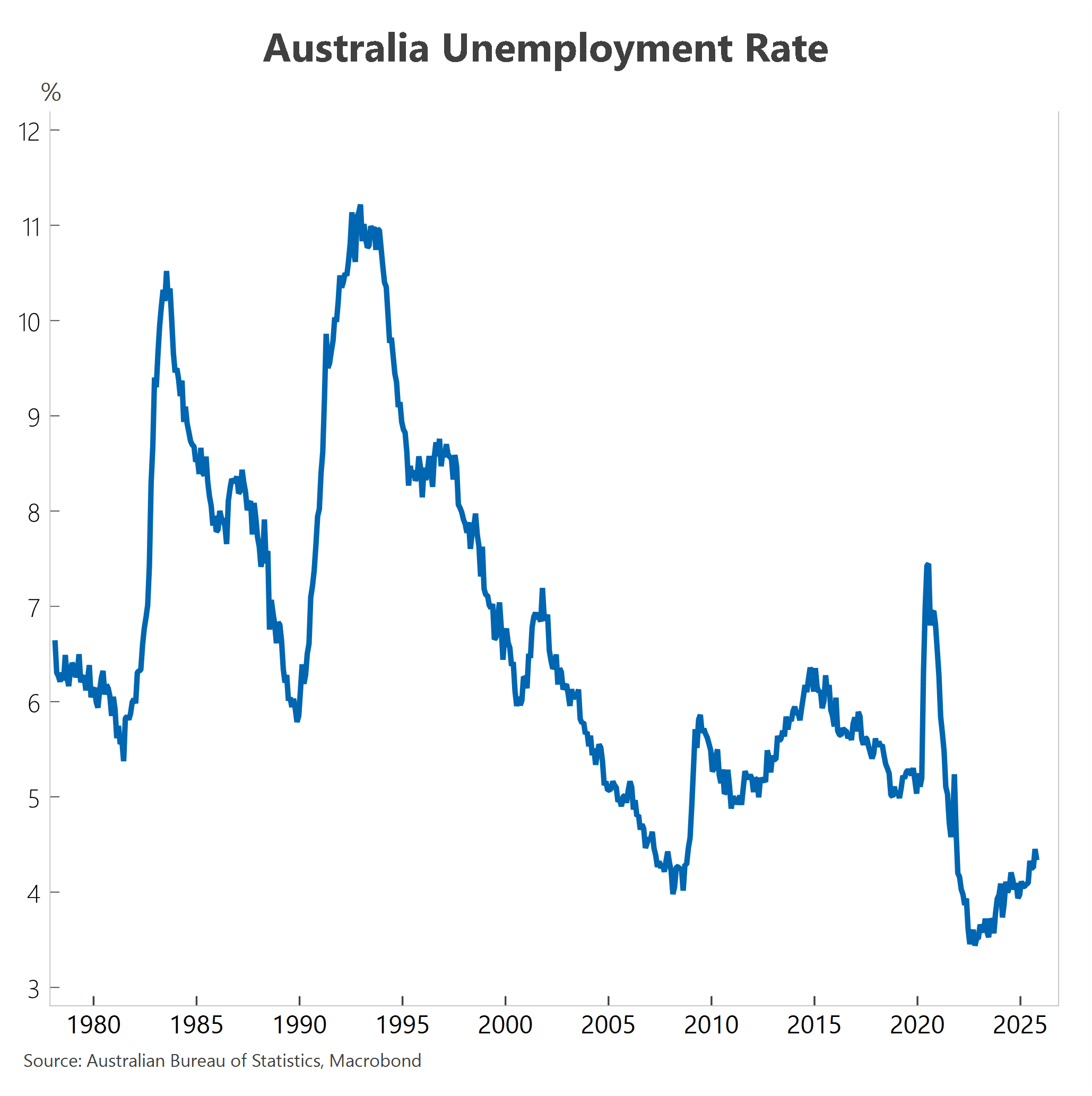

National unemployment fell to 4.3% in October, down from a near-four-year high of 4.5% in September. Employment surged by 42,200 jobs with full-time roles accounting for the entire increase. Full-time positions rose by 55,300, while part-time roles contracted by 13,100.

The renewed strength in the labour market follows a period of softer momentum earlier this year and arrives at a critical juncture for monetary policy. The October jobs data reinforces the RBA’s recent assessment that labour market conditions “remain a little tight”. The RBA has already delivered three rate cuts this year, bringing the cash rate to 3.60%. However, underlying inflation data for the September quarter revealed disinflation has stalled. The underlying annual inflation rate rose to the top of the inflation target band and is expected to rise further.

With underlying inflation expected to remain above 3% through the first half of next year, and with this renewed strength in employment, the RBA faces very limited scope for additional rate cuts. Not surprisingly, financial markets have responded by sharply repricing expectations.

Following Deputy Governor Hauser’s remarks likening the economy to a ‘racehorse boxed in at the gates’, a reference to historically high-capacity utilisation and structural productivity constraints, we see the chance for further monetary easing as severely curtailed. The rate-cutting cycle appears over after just three rate reductions.

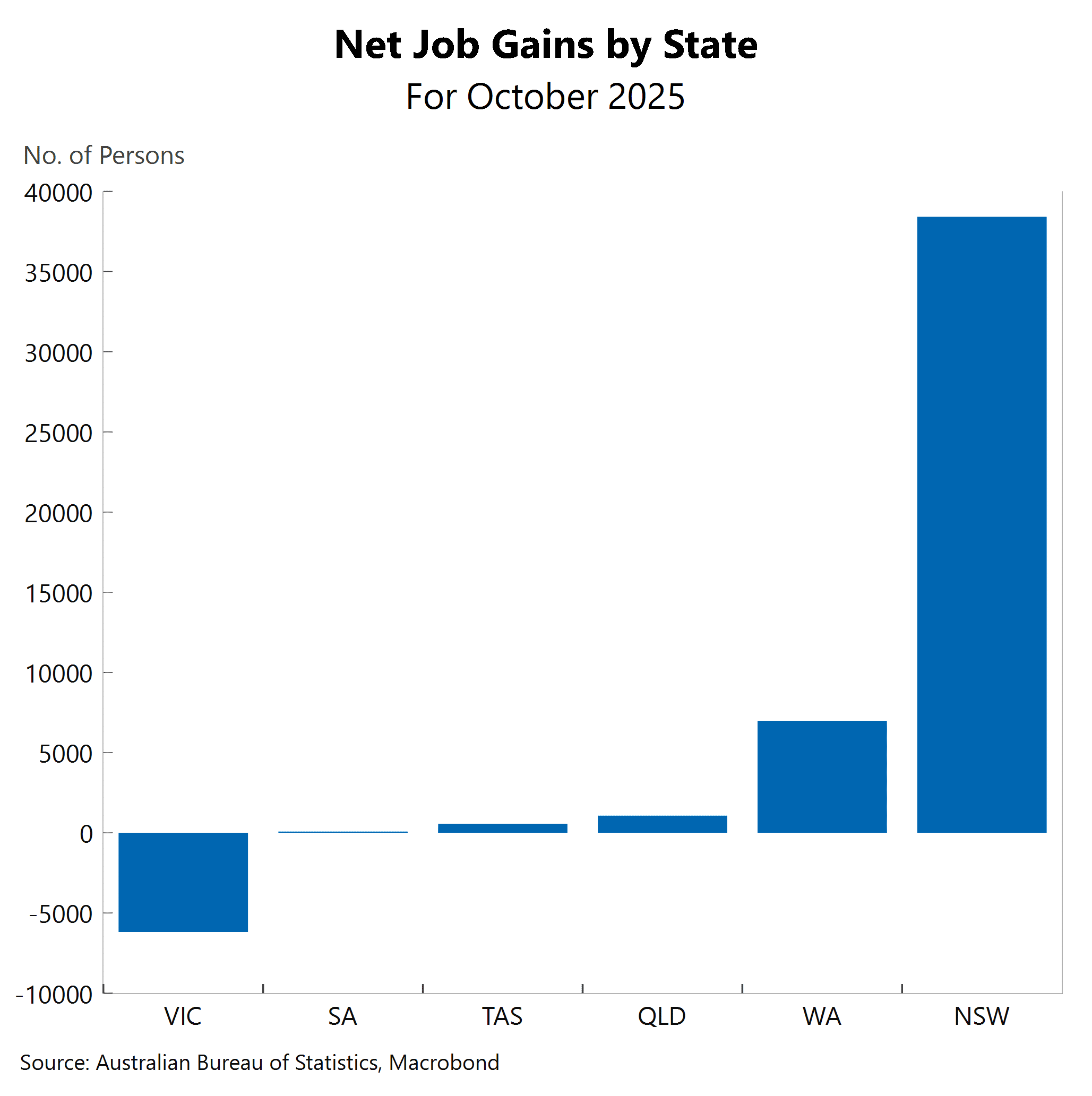

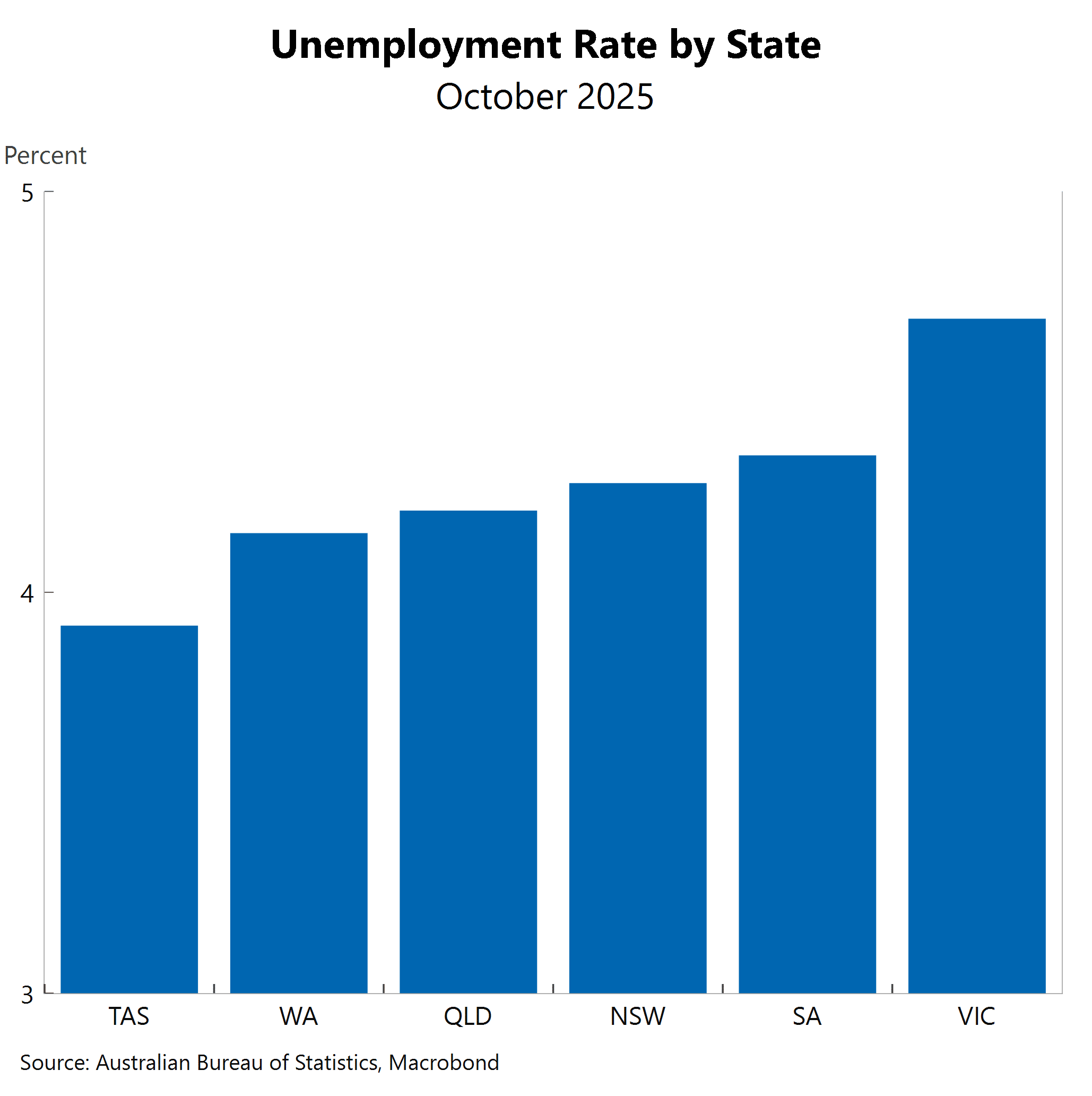

The labour market has been volatile in recent months. The geographic distribution of gains adds another dimension. NSW accounted for a substantial portion of October’s employment surge adding 38,400 jobs – over 90% of the national total. However, only Victoria and the Northern Territory recorded job losses, and both were modest declines. The unemployment rate in NSW dropped to 4.3% and all states and territories now have an unemployment rate that is equal to or lower than the national rate except for ACT (4.5%), Victoria (4.7%) and NT (5.2%).

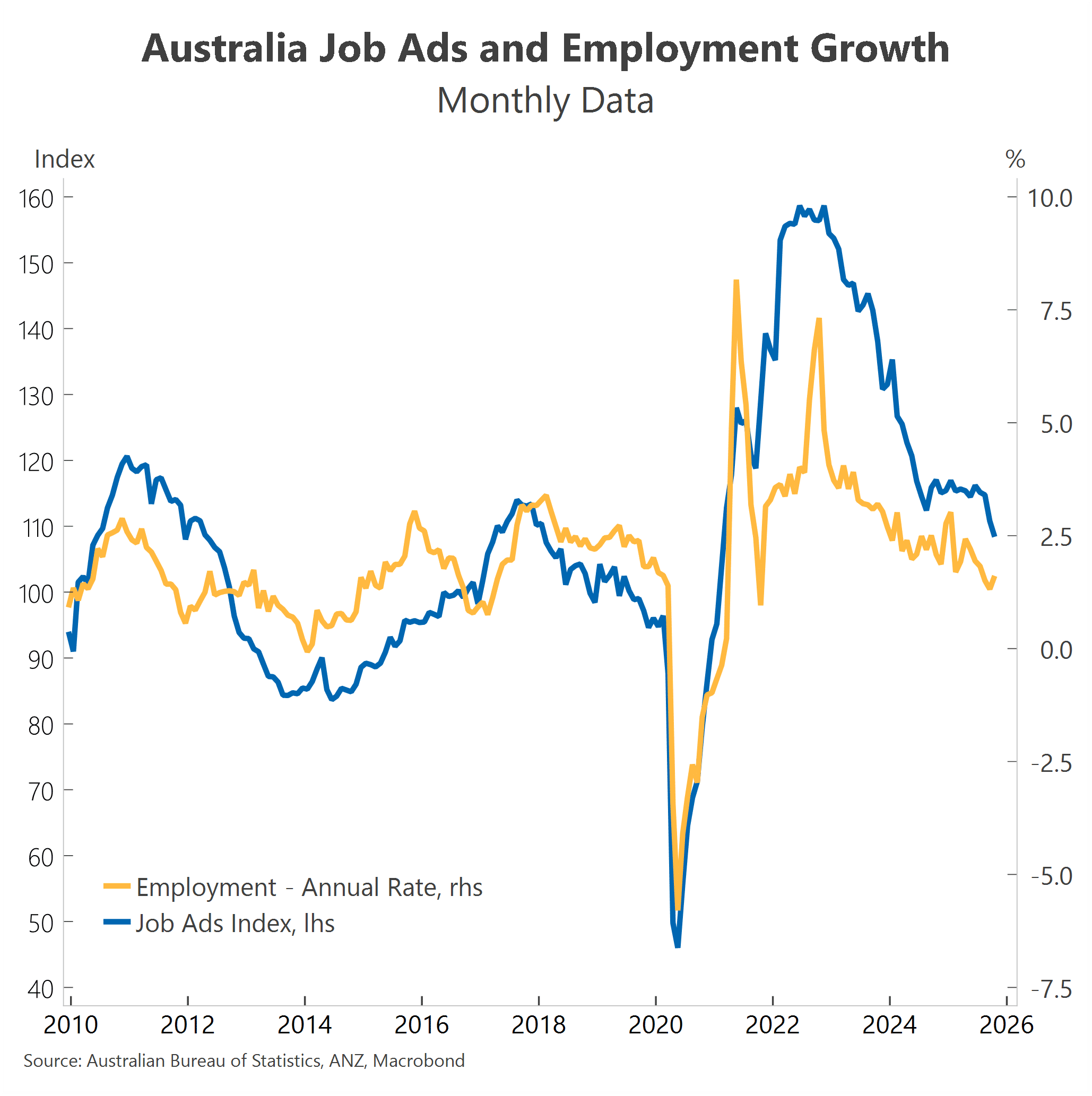

Some forward-looking measures suggest some softening may resume, while others point to ongoing tightness. Job advertisements while weaker than their peak, remain high relative to history. And hours worked gained 0.5% for the second straight month, helping the annual rate accelerate to 2.1%, from 1.4% in September. This suggests businesses are squeezing more output from existing staff, which often signals stronger demand and could lead to additional hiring if economic momentum persists.

We recently held an industry roundtable with recruitment businesses and some of the key themes included persistent shortages in some pockets (especially construction and roles requiring a Certificate III/IV), difficulty attracting younger people to trades, higher costs of sourcing offshore talent, the growing importance of communication and negotiation skills in securing roles and risks around the hollowing out of early-career experience due to AI adoption.

The RBA’s latest forecasts, published earlier this month, project a flat unemployment rate of 4.4% through to the end of 2027. This is consistent with the current quarter’s average. With inflation stickier than anticipated, for Australian households, today’s strong jobs report effectively reduces, and likely eliminates, the prospect of more mortgage relief.