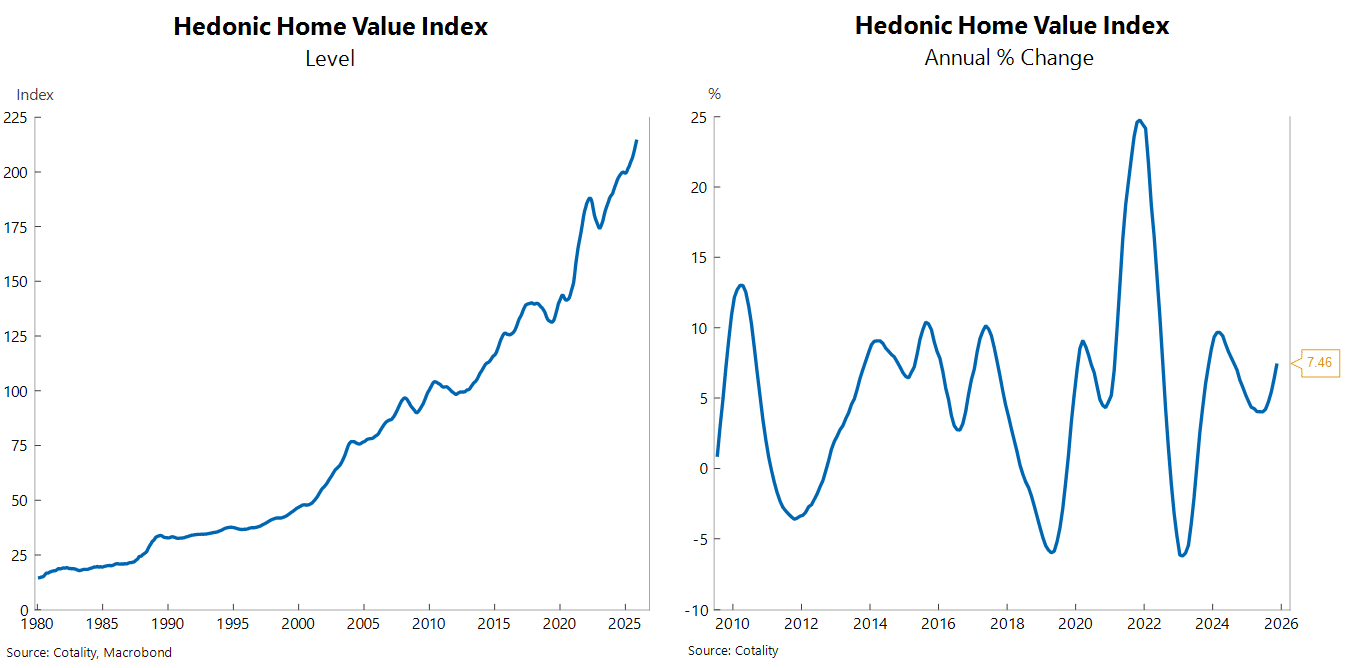

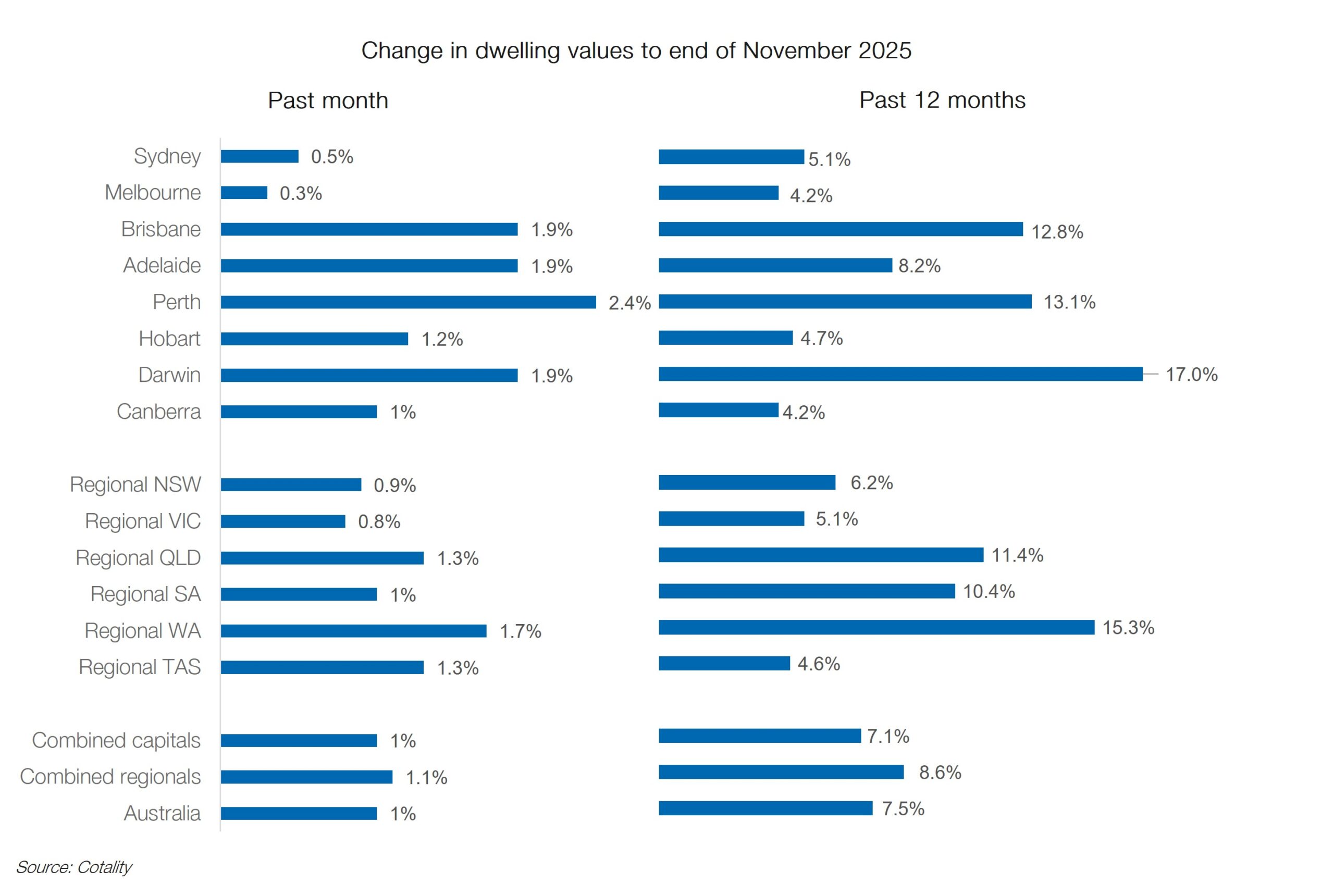

Cotality’s national home value index climbed 1.0% to a new peak, marking three straight months of robust growth between 1.0% and 1.1%. This is a clear acceleration from the 0.4% to 0.9% monthly increases recorded between February’s first rate cut and August. On an annual basis, national home values rose 7.5% in November, the fastest pace in 16 months. Regional outpaced the capitals, growing 8.6% versus 7.1% year on year.

Since February 2025, dwelling prices have risen by 7.2%, buoyed by three rate cuts earlier this year. Changes to the First Deposit Scheme from 1 October have also helped spur first-home buyer activity. A nationwide shortage of dwellings also continues to drive prices higher, especially in Perth (+2.4% month-on-month or m/m), Brisbane (+1.9% m/m) and Adelaide (+1.9% m/m). Darwin also posted strong growth in the month (+1.9% m/m).

Housing affordability is becoming increasingly stretched with price growth more subdued in cities like Sydney (0.5% m/m) where unaffordability is at its highest and mortgage sizes are the largest in Australia. Melbourne also recorded mild growth in the month (0.3% m/m).

This data follows APRA’s announcement last Thursday to cap the share of new mortgages with a high debt-to-income (DTI) ratio, defined as six times or more the borrower’s household income, to 20% of any lender’s new loan book. This new measure is effective 1 February 2026. The cap applies separately to owner-occupier and investor loans, aimed at reining in riskier lending and safeguarding financial stability. The measure is also designed to guard against mortgage stress if interest rates rise and/or incomes fall. For example, a household earning $100,000 with a DTI of six times would align with a $600,000 loan; any borrowing above this threshold will face greater scrutiny from authorised deposit-taking institutions (ADIs). Notably, non-bank lenders are excluded, which could see risk shift toward that sector.

We expect only a modest impact from APRA’s new measure, as most mortgage originations remain below a DTI of six. Where there is an impact, it should be greater on investors who typically have higher debt-to-income ratios. However, the measure does not address the supply-side housing challenges that are driving higher prices and worsening affordability. The shortage of dwellings remains a key issue. Listings are 16% below average for combined capital cities.

We had pencilled in a rate cut for the September quarter of next year, but increasingly the data points to the end of an easing cycle. Whilst some of the price pressures are temporary, we no longer expect any further rate cuts from the Reserve Bank. It means, we now anticipate dwelling prices to grow 7-7.5% next year, which is a touch softer than our earlier predictions.