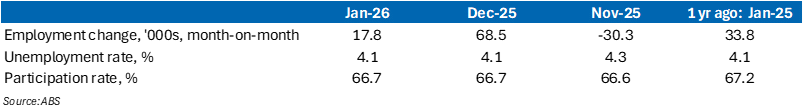

Australia’s labour market data delivered a strong set of results, keeping the case for further RBA tightening firmly alive. Employment rose by 17,800 in January and increased by 86,400 over the past two months, the strongest back-to-back outcome in nine months. Importantly, the gain in January was driven by fulltime employment, the more stable segment of the labour market. In fact, fulltime jobs increased by 50,500, while parttime employment fell by 32,600. Taken together, fulltime employment has risen by 107,300 over the past two months — the strongest run since March 2024.

The participation rate held steady and the unemployment rate remained low and steady at 4.1% in January. When measured to the second decimal place, a professional habit economists find hard to resist, the unemployment rate fell to a 19-month low.

Employment momentum is also showing through in the forward indicators. Job advertisements recorded their largest increase in four months in January, reinforcing the view that employment growth can be sustained at a solid pace in the near term.

However, the detail tilts toward no move at the next RBA meeting on 17 March, St Patrick’s Day, and instead points to the meeting after that on 5 May. Mortgage holders will be hoping the luck of the Irish holds (full disclosure, my son was born on St Pat’s Day).

Looking through the detail, the labour market strength is less broad-based than the headline suggests. Around 72% of January’s job gains came from Queensland. A sharp lift in the participation rate in the Sunshine state pushed the unemployment rate up to 4.3%, which disguises some of the underlying strength of the labour market. Across the other states, Western Australia recorded the lowest unemployment rate at 3.4% in January, while Tasmania had the highest at 4.9%.

Our business liaison suggests that sourcing quality labour is becoming more difficult, particularly across some geographies and industries. Queensland and the construction industry stand out in this regard.

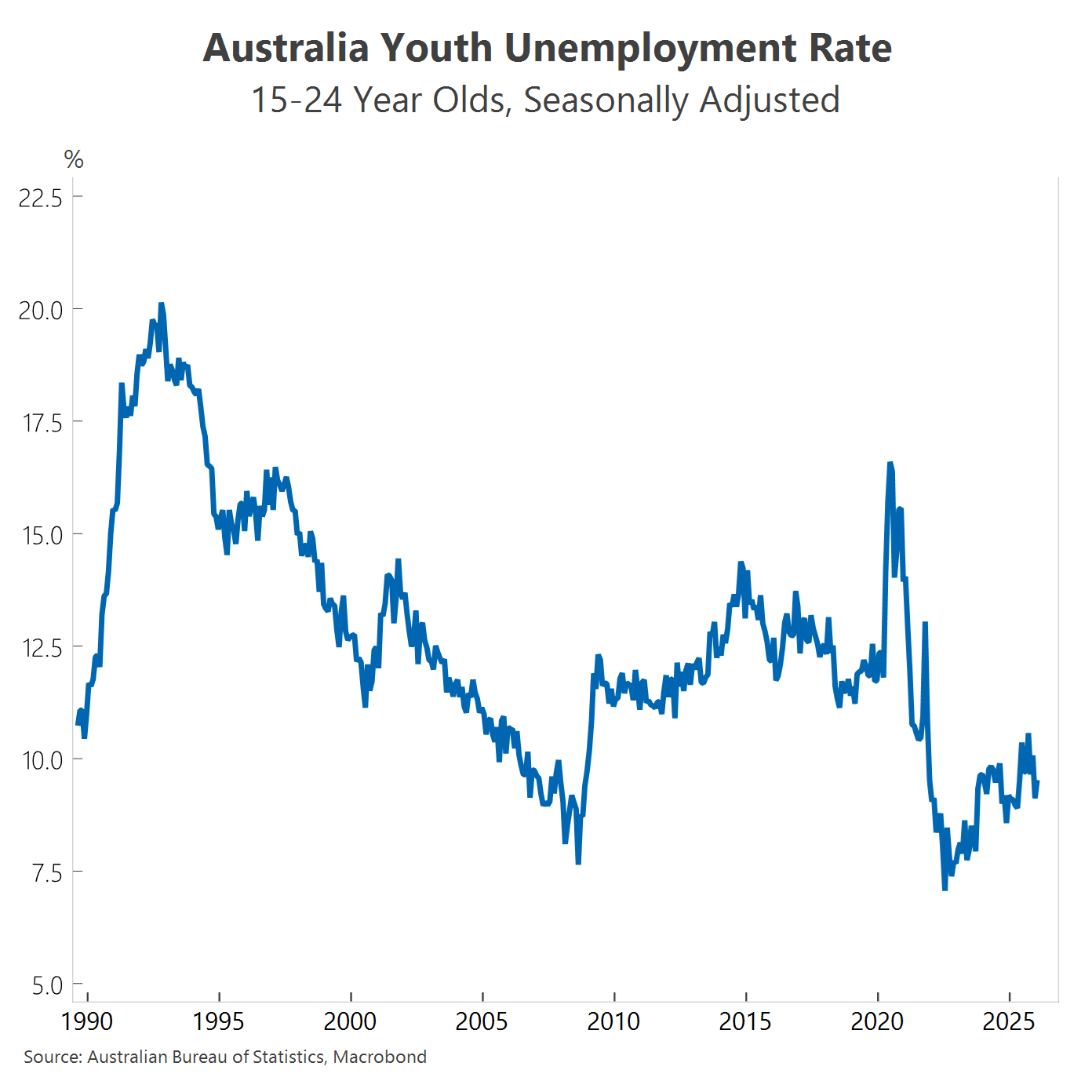

At the same time, there is rising sentiment that conditions at the entry level have become more challenging. Youth unemployment has edged up from 9.1% to 9.5% and has carried a ‘9’ handle since late 2023. It can feel harder for younger workers in part because this shift has come off a very low starting point. Youth unemployment troughed at a record low of 7.1% in July 2022. Even so, it remains well below the peak of 20.1% recorded during the early 1990s recession.

Hours worked rose by 0.6% in January, the sharpest increase in eight months. However, the Australian Bureau of Statistics cautioned against reading too much into the result, noting that fewer people than in a typical January reported working fewer hours due to being on leave.

Source: ANZ, Macrobond