The RBA redeemed itself in August, delivering the widely anticipated 25-basis-point cut that markets and economists had expected last month. The move takes the cash rate to 3.60%, the lowest since April 2023 and marks a cumulative reduction of 75 basis points so far this year. A larger rate cut was not discussed. And, the board decision was unanimous, unlike the 6-3 split last time.

The RBA treaded cautiously in July’s meeting, opting to wait for the quarterly inflation data before acting. That data showed underlying inflation easing in line with their forecasts to 2.7% in the June quarter, close to the midpoint of the 2–3% target band. Together with a labour market performing as expected, this confirmation paved the way for today’s rate cut.

The big question now is how much further rates will fall. The Governor signalled that the policy bias remains towards further easing, stating the Bank’s forecasts imply the cash rate ‘may need to be lower than where it is today’. Much will continue to depend on the data and how economic conditions evolve. Indeed, the Governor highlighted uncertainty and unpredictability as an ongoing feature of the economic outlook.

We still expect two more rate cuts, in November 2025 and February 2026, assuming the RBA sticks to its cautious, gradual approach. That pace carries the risk of deeper cuts being needed next year. However, the rhetoric from the Governor in the press conference did not suggest any enthusiasm to move away from this type of approach. There was an emphasis on weighing up the data and information and assessing policy on a ‘meeting by meeting’ basis. At the same time, the Governor also watered down the prospect of back-to-back cuts (in response to a question). Interest-rate markets are fully priced for two more rate cuts with a third rate cut partially priced.

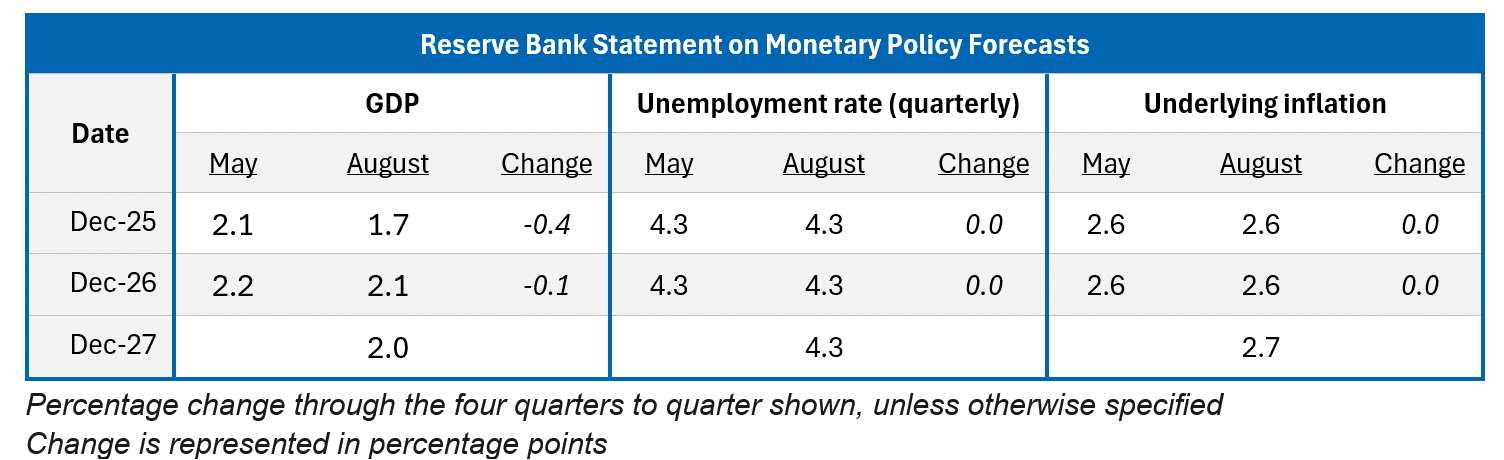

The RBA published updated forecasts today in its quarterly Statement on Monetary Policy. It refreshes the projections last issued in May. In our view, the new forecasts confirm the easing bias.

A notable feature of revisions was a downgrade to productivity growth assumptions, which drew significant attention. Governor Bullock stressed this is an assumption rather than a modelled projection and not the focus.

Source: Reserve Bank, William Buck

Beyond productivity, the RBA revised down its economic growth forecasts for 2025 from 2.1% to 1.7%. Growth was also revised lower in 2026. Both downgrades to growth reflect softer productivity and a slower recovery in private demand, especially household consumption. By December 2027, growth is projected to lift modestly to 2.0%, which is well down on Australia’s estimated potential.

The tepid economic recovery underscores the need for more rate cuts, especially as the RBA has grown more confident of underlying inflation returning to the target mid-point on a sustained basis. The underlying inflation forecasts were left unchanged from May. However, the extended horizon to end-2027 shows underlying inflation reaching the midpoint at the end of the period. Importantly, this is contingent on ‘a couple more rate cuts.’

Internationally, the Governor described the global economic outlook as ‘unpredictable’. The Board expects global growth slow this year and next, even if some of the worst tariff outcomes appear to have been avoided. She observed that markets remain ‘pretty sanguine’, despite the risks, leaving the door open for bouts of volatility. This aligns with our view, expressed in our recent Investor Intelligence report, that equity markets appear too complacent.

The information in this article is general in nature, intended for informational purposes only and does not constitute financial, investment, legal or professional advice; readers should seek guidance from qualified professionals before making decisions based on its content.