What a sensational set of employment numbers or as the Italians would say sensazionale! Everything always sounds better in Italian and yes, I’m still working remotely in Italy for a little while longer.

Employment in Australia spiked by 65,200 in December, which is the biggest jump in eight months and well above consensus forecasts for a rise of only 27,000. Full-time employment gained 54,800 and part-time jobs added 10,400. Furthermore, the unemployment rate dropped to 4.1%, the lowest since May 2025.

The improvement in the labour market comes at a critical point in the debate about whether the RBA will hike in 2026 or stay on hold. We have carried a rate hike in our forecasts since late last year. May has been our preferred timing for a rate hike, although we have not ruled out an earlier move in February. For mortgage holders, this set of data means a rate hike in the near term is looking more probable, especially if this month’s inflation data shows persistent price pressures.

For the December quarter, the unemployment rate has averaged 4.2%, down from 4.3% in the September quarter. Importantly, the average for the December quarter is under the RBA’s forecasts of 4.4% for the same period published only recently in November (as part of the Statement on Monetary Policy). That will leave the RBA uncomfortable, especially as the inflation backdrop is still pointing to persistent price pressures.

And so, the strength in the employment data adds momentum to the case for a February move, as long as this month’s inflation numbers confirm ongoing price pressures. It also boosts the prospect of a second hike this year, taking the cash rate to 4.10% by the end of this year.

We published our Big economic picture – 2026 report earlier this week and highlighted how data dependant the RBA’s decisions are. A recent poll by the Australian Financial Review underscored this. Out of 36 economists surveyed, 11 expected tightening in 2026, including us, 9 expected easing and 16 projected an extended hold. End of 2026 cash rate forecasts ranged from 3.10% to 4.50% versus the current cash rate of 3.60%. Even if the RBA stays on hold, the prudent assumption is a restrictive policy setting for longer and households should plan for no more mortgage relief in 2026.

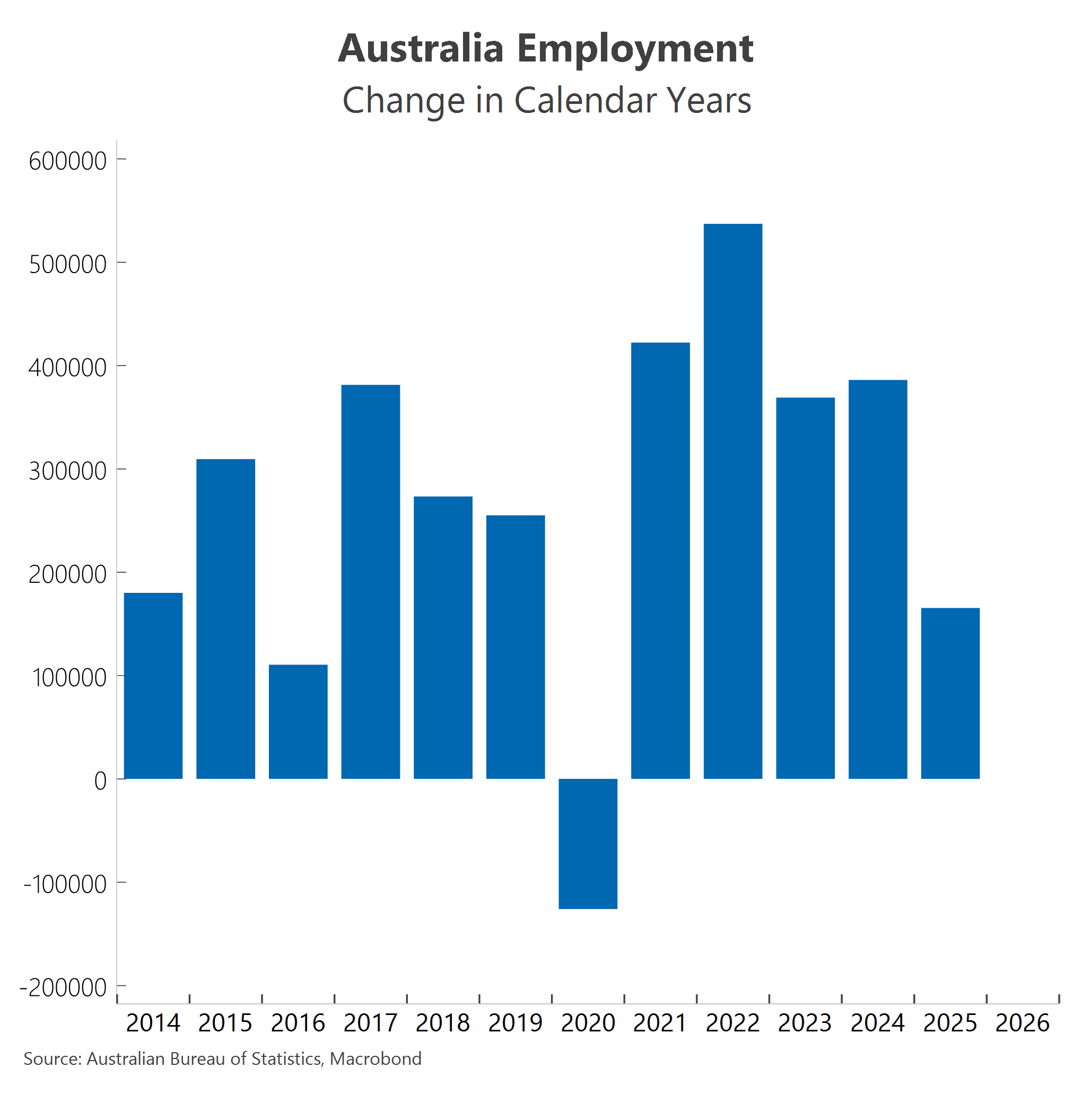

The year ended on a stronger note, though momentum over 2025 was cooler than earlier in the cycle and in recent years. Employment rose by 165,382 last calendar year, the slowest annual gain since 2020, even after the late year pick-up from firmer economic activity and an uplift in consumer spending. The prior annual increases were 386,050 in 2024, 369,025 in 2023, 537,303 in 2022 and 422,303 in 2021. Of course, these years did carry some covid impact, during and after the pandemic.

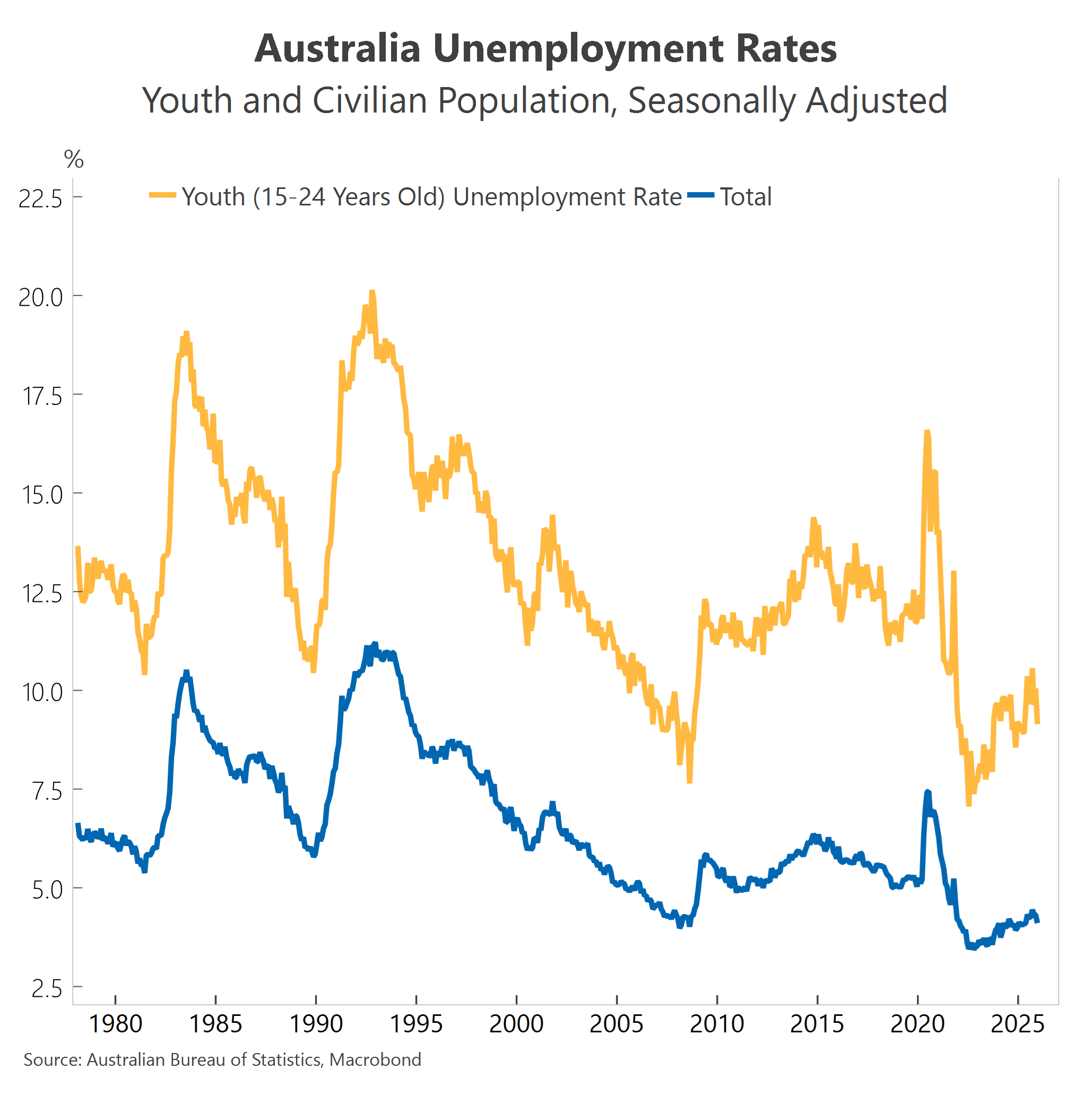

One of the standouts in the data was the youth unemployment rate among 15-to-24-year-olds. It dropped sharply to an eight-month low of 9.1%, from 10.0% in November.

Other measures of the labour market also pointed to broad based strength in the December data. The underemployment rate fell to 5.7% in December, from 6.2% in November. And the underutilisation rate dropped to a near three-year low of 9.8%. Moreover, the employment-to-population ratio lifted to a seven-month high of 64.5%.

Employment is volatile month to month, but smoothing it out, for example by using the twelve-month-moving average, shows an uplift came through at the end of last year. The twelve-month-moving average was around 13,800, although down from around 35,200 at the start of 2025. Forward-looking indicators of the labour market are consistent with ongoing tightness and a slight drift higher in the unemployment rate. We continue to expect the unemployment rate to end 2026 near 4.5%, including because our forecasts incorporate tighter monetary policy, which will temper jobs growth.

Across the states, WA led the gains. And here in this little town in Italy, the connection to Australia runs deep, especially with Perth. There is even an emigration statue honouring the Italians who made the journey to Australia, many of whom settled in WA. Employment in WA rose 26,200 in December, the sharpest rise since February 2024 when it recorded a rise of the same size. The unemployment rate in WA dropped sharply to 3.9% and equals the rate in NSW, SA, QLD and NT, which are likewise at 3.9 %. The lowest unemployment rate across the states and territories is in the ACT: 3.5%. Victoria and Tasmania have higher unemployment rates of 4.6% and 4.5%, respectively.

Disclaimer

This report has been prepared for general informational purposes only and does not constitute personal financial advice. It does not take into account your specific objectives, financial situation, or needs. Before acting on any information in this report, you should consider its appropriateness in light of your circumstances and seek independent financial advice. The author holds, or may hold, positions in some of the securities mentioned in this report. These holdings may represent a potential conflict of interest. No representation or warranty is made as to the accuracy, completeness, or reliability of the information contained herein. Past performance is not a reliable indicator of future performance.