A small confession before we begin…

For a few weeks, I’m living what a colleague optimistically called my “cool, digital‑nomad era.” I’m working from a buzzing Italian café while we wait for the hospital to clear my youngest to fly home after a broken wrist and surgery. A young American couple even dubbed me a “fun mum” the other day. My family strongly disagree and, to be fair, clipping a tram in Milan and triggering a two‑hour traffic snarl didn’t exactly help my case. And yes, passers‑by filmed the whole thing, probably for their social feeds – I can only hope the algorithm was kind. So, here I am, piecing together the 2026 outlook with espressos and a melodic soundtrack while my kids bravely navigate Italian school. They speak no Italian and are mastering a timetable that includes siestas – Saturday school deserves its own report.

Temperature drops, risks gather

2026 opened with a sharp cold front across Italy and much of Europe. Temperatures plunged to –16°C on 11 January, the same day a new wave of US political risks swept through. Chief among them was the US government placing Federal Reserve Chair, Jerome Powell, under criminal investigation. It is an extraordinary development and a direct threat to the independence of arguably the world’s most important central bank. Central bank independence sits at the core of modern inflation targeting regimes and with fiscal debts rising across major economies, it is something worth watching. A threat to the independence of the US central bank may not stay contained and could carry implications for the independence of others.

Icy geopolitics, gold steals the show

With cold conditions come snow and occasionally black ice, the kind I make every effort to avoid. Similarly, global conditions have been unsettled by an upswing in geopolitical risk. Investors are watching US actions involving Venezuela, heightened tensions in the Middle East, including Iran, and a series of unexpected foreign‑policy signals, such as recent comments about Greenland.

There has been more of a bid towards safe-haven assets, like gold, on the back of these developments. Indeed, spot gold hit a new record high of US$4,671/t oz on 19 January. Some analysts are now predicting a break above US$5,000/t oz.

However, geopolitics may challenge that expectation. According to Bloomberg’s consensus of commodity analysts, gold is expected to finish 1.6% higher at the end of 2026 at US$4,785/t oz compared with the closing price on 19 January of US$4,4671/t oz. Silver is expected to decline 3.9% from the spot record price on 19 January of US$94.39/t oz. Inflation pressures and a move away from the US dollar are also supporting precious-metal prices. The silver-to-gold ratio has risen sharply to its highest since 2011, helped by the tight physical supply of silver and the US government classifying silver as a “critical mineral” in November 2025.

Oil follows politely…

Oil prices have been firmer too, although in a far more restrained fashion than gold. Geopolitical risks, particularly around Iran, Venezuela and pockets of supply disruption, have added a short lived risk premium. However, a looming oversupply continues to cap prices. The West Texas Intermediate (WTI) price briefly pushed up to US$62.36 a barrel on 14 January, only to fall back below US$60 a barrel. The premium was unwound as reports emerged that the US government would hold off on strikes against Iran. The risk has not fully disappeared. Oil has peeked its head over US$60 a barrel again. Iran still produces more than 3 million barrels a day and around 20 million barrels pass through the Strait of Hormuz, but each day without escalation sees the war risk component fade.

In an extreme case, where Iranian exports are removed from the market, WTI prices could move above US$70 a barrel in 2026 and even approach US$90 a barrel if the removal is for an extended time. But if tensions simmer rather than spill over, we expect oil prices are more likely to hover in the US$50-60 a barrel range. This forecast reflects the fundamental backdrop where supply growth continues to outpace demand and OPEC+ output is creeping higher. Disruptions to Kazakhstan’s oil exports, and the stop‑start nature of Venezuelan supply under US sanctions, can lift prices temporarily, but they have not altered the broader picture. Futures curves also signal a fairly contained price path.

|

|

Markets have a mind of their own

Markets have remained surprisingly resilient despite the geopolitical backdrop and heightened uncertainty. It is a reminder that risk sentiment really does have a mind of its own. Neither the US attack on Venezuela and the arrest of President Maduro, nor President Trump’s expressed interest in Greenland and his refusal to rule out military intervention, managed to knock equities off course. Instead, many major share markets pushed to new all‑time highs before a round of profit‑taking set in. These included the US S&P 500 index on 12 January, the Euro Stoxx 50 on 15 January, Japan’s Nikkei on 15 January and the UK’s FTSE 100 index on 16 January. The tech‑heavy Nasdaq‑100 is only 2.0 per cent below its peak in October 2025, after concerns late last year that capex investment in AI and related infrastructure was not paying off briefly unsettled investors.

A widely watched measure of market sentiment is the Volatility Index (VIX). The higher the VIX, the more risk‑averse investors tend to be. It ended 2025 at 14.5 and rose to a high of 18.1 on 15 January, before easing back below 16.0. For context, the VIX spiked above 50.0 when President Trump first announced a raft of tariff changes on “liberation day”. Recent movements look modest by comparison, underscoring how well‑supported markets have been at the start of the year.

US Federal Reserve set for lower rates and a fresh nameplate

Yet uncertainty continues to accumulate and it is casting a shadow over US and global growth prospects. The US enters 2026 with a murky mix of softening jobs data, sticky inflation and still solid growth, all made harder to interpret by the (recent) longest government shutdown on record. Non‑farm payrolls rose just 50,000 in December and have been weak in six of the past seven months, while the unemployment rate sits at 4.4%. This is well above the lows of 2023, but not far from where it was when the labour market first began to cool. Inflation is easing, although the Federal Reserve’s preferred measure remains sticky and above the target of 2%, underscoring the difficult position the central bank finds itself in.

Against this backdrop, the Fed looks set to keep nudging policy toward neutral rather than racing there. Markets see scope for two more cuts this year and our view is consistent with that. The Fed meeting this month is unlikely to deliver any major shifts. Political noise continues to complicate the picture: Chair Powell’s term expires in May. With government pressure increasingly shaping the debate around the Fed, there is more uncertainty than usual over the policy path ahead. The prospect of a leadership change in the middle of a changing economic environment adds to that unease. Trade and tariff uncertainty is also resurfacing. President Trump has recently signalled plans to impose a 10% tariff from February on select European countries that have pushed back against his Greenland proposal, further clouding the global outlook.

Australian share market back near the summit

The Australian share market index, the S&P / ASX 200 index sold off sharply in late October, falling 7.5% between 21 October and 21 November, before rebounding to sit just 2% below its peak, a recovery that occurred despite a material shift toward a more hawkish monetary‑policy outlook in Australia. Strong gains in gold and commodity prices have been instrumental in this rebound, propelling the Materials sector, which carries a weighting of almost 25% in the index, substantially higher. Indeed, the materials sector returned 33.1% in 2025, compared with a return of 7.2% for the S&P/ASX 300 index and 13.4% for industrials, the second-strongest performing sector for 2025. The question begs how long the rally in Materials can last. We think the sector may have further upside in 2026, supported by a weak US dollar, tight supply and resilient demand across many commodities.

We also expect 2026 to be characterised by greater investor selectivity, both within Materials and across the broader share market. The possibility that the RBA’s next move could be a rate hike also suggests a tilt toward a more defensive tone. Our base case is that the RBA will tap the brakes with one increase, and no more than two, tightening financial conditions modestly while keeping earnings growth largely intact.

Valuations, however, remain a constraint. The S&P/ASX 200 is trading on a forward price‑earnings multiple of 18.7 times, well above its long‑run average of 16.6, meaning earnings will need to carry more of the load from here. Combined with a backdrop of greater stock‑level dispersion, this strengthens the case for selectivity as investors differentiate between companies capable of delivering resilient earnings in a tighter policy environment.

|

|

A rising pressure system at RBA headquarters

Late last year, the risk profile around Australian monetary policy shifted meaningfully. The RBA’s short‑lived and shallow easing phase has ended, replaced by mounting pressure to tighten again in 2026. Firmer activity data, stronger household spending, low unemployment and sticky underlying price pressures have all lifted the probability of a rate hike.

The turning point arrived in late October when quarterly inflation data showed underlying inflation jumping to 3.0% in the year to the September quarter, placing it right at the top of the RBA’s 2–3% target band. We expect annual underlying inflation to push to around 3.3% by mid-year before easing back toward the upper end of the band by year’s end. This trajectory keeps the RBA under pressure, especially as domestic demand remains more resilient than anticipated. Household spending growth grew at its fastest since September 2023 at 6.3% year-on-year.

The November monthly consumer price index (CPI) released on 7 January showed headline inflation flat in original terms, bringing the annual rate down to 3.4%. The softer headline result was dominated by volatile items. The trimmed‑mean measure rose 0.3% in the month and eased slightly to 3.2% year‑on‑year. These figures should be interpreted cautiously, particularly as the monthly series is still relatively new. We remain sceptical that it signals any meaningful slowdown in underlying demand. In fact, the underlying detail continues to show ongoing pressure in categories for market services and housing.

Where does this leave rates? In the economists’ survey published by the Australian Financial Review (AFR) on 5 January (end polled on 22 December), we pencilled in a May rate hike. It’s a view we hold with low conviction. A February move can’t be ruled out, but the quarterly inflation print due later this month would need to land hotter than the RBA’s own expectations to bring action forward. Equally, an extended hold remains possible if the Bank chooses to look through near‑term overshoots on the basis that inflation will drift back into the band over the medium term.

The same survey underscores how data‑dependent the outlook remains. Of 36 economists, 11 expect tightening in 2026 (including us), 9 expect more easing and 16 see an extended hold. End‑2026 cash‑rate forecasts range from 3.10% to 4.50% versus the current cash rate of 3.60%. Futures are fully priced for one hike by August, with another partially priced before year’s end. Both market pricing and the survey point to rising upside risk for borrowing costs. Even if the RBA ultimately stays on hold, the prudent assumption is a restrictive policy setting for longer and households should plan accordingly. RBA lending data show a 28-basis-point gap between variable, discounted and three‑year fixed mortgage rates (see chart).

|

|

House prices – cooling, but not cooling off

House prices picked up the pace in the second half of 2025, although the possibility of rate hikes is likely to lead to some moderation this year. In December 2025, Cotality’s home value index (across regions and capital cities) rose by 0.7%, the smallest monthly increase in five months, as speculation of an early 2026 rate hike gained traction. Prices growth has been led by investors. The latest data shows investor housing credit grew by 8.1% in November, well above the 5.9% annual pace for owner‑occupiers and the fastest rate since 2015, reflecting strong population growth and a lift in nominal household disposable incomes. The Australian Government’s expanded 5% deposit scheme took effect on 1 October 2025 and has supported values in eligible price ranges while boosting first‑home‑buyer demand.

The Australian Prudential Regulation Authority (APRA) announced last year that from February 2026 it will introduce caps on high debt‑to‑income lending, limiting banks to issuing no more than 20% of new loans with debt‑to‑income ratios above six. We expect this measure together with the possibility of tighter monetary policy and an improving trend in building approvals to contribute to a moderation in dwelling prices from the current pace. However, there will be ongoing support to prices from demand outstripping supply amid ongoing strong population growth. We are forecasting dwelling prices to grow by 6.5% in 2026. Regional variations will continue.

Labour market – cooling at the edges

The shifting monetary-policy outlook is mirrored in the labour market where conditions remain resilient even as signs of cooling emerge. Vacancies remain high by historical standards, though partial indicators point to an economy gradually moving away from the very tight conditions of recent years. Employment growth slowed through 2025 and a further, modest easing appears likely in 2026. We expect the unemployment rate to edge up to 4.5% by the end of next year.

Businesses focussed on digital and data to lead the way

Businesses are also leaning more on existing staff to meet demand, reflected in the improving trend in rising monthly hours worked. The momentum in business credit remains intact. Business credit growth was 9.2% in November, which is down from the peak of 10.0% in July. We had flagged to clients this sort of pace would not hold up and we anticipate a moderation to around 7.0% this year, still a firm rate. Anticipated higher interest costs are a part of the reasoning for the moderation. Those businesses that are expecting to increase their investment are typically focused on automation, digital transformation and data centres.

Bond yields to hold at elevated levels

Both business and consumer confidence have stepped back in the latest readings, reflecting the possibility of a rate hike from the RBA in 2026. This expectation is reflected in 2-year and 3-year bond yields, which have trended higher since mid-October 2025. We expect them to move up further, towards highs last seen in November 2024, as markets are now fully priced for one full RBA hike by August 2026 with a follow up move partially priced. Ten-year yields have also moved higher due to larger projected budget deficits, global rate moves, RBA expectations and inflation risks. We have a modest further steepening bias priced in by year’s end to the Australian curve.

Aussie dollar’s tailwinds

Widening Australian-US rate differentials and a soft US dollar backdrop should support demand for the Australian dollar through this year. The RBA is projected to lift the cash rate to 3.85% and the Fed should continue easing to 3.00-3.25%, leaving the AUD with a relative yield advantage. We expect the AUD to push towards 70 US cents as the year progresses. Firmer commodity prices and Australia’s resilient domestic backdrop provide additional support, however, geopolitical tensions and global risk sentiment could generate volatility and cap the rise. Across the major currencies, the outlook favours a softer US dollar, driven by Fed policy easing, political uncertainty in Washington and improving growth momentum elsewhere.

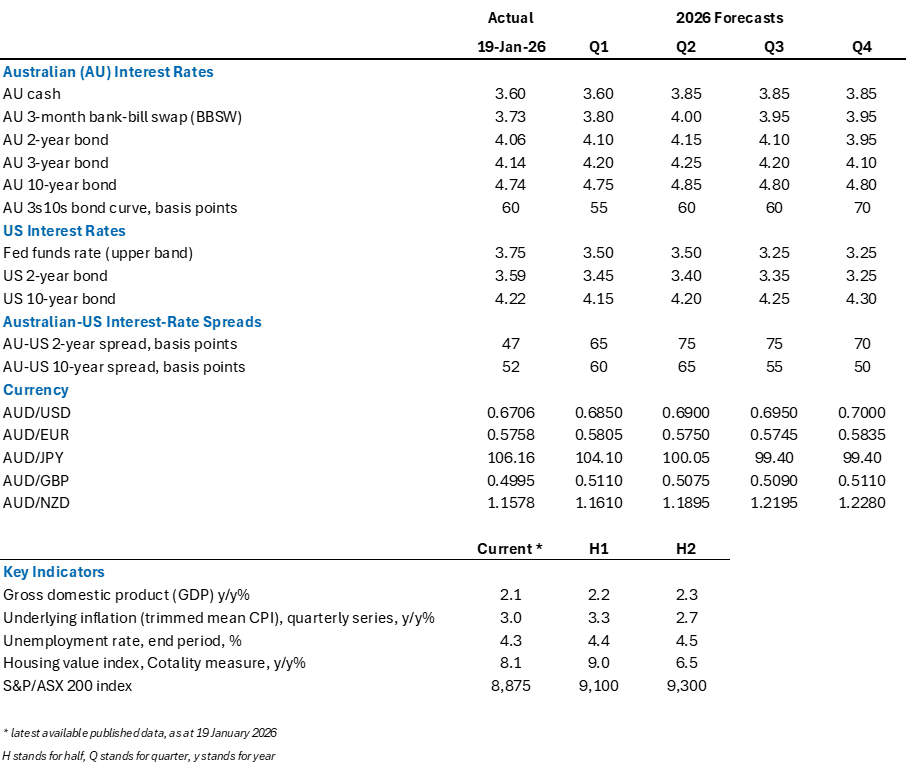

William Buck forecasts for 2026

Disclaimer

This report has been prepared for general informational purposes only and does not constitute personal financial advice. It does not take into account your specific objectives, financial situation, or needs. Before acting on any information in this report, you should consider its appropriateness in light of your circumstances and seek independent financial advice. The author holds, or may hold, positions in some of the securities mentioned in this report. These holdings may represent a potential conflict of interest. No representation or warranty is made as to the accuracy, completeness, or reliability of the information contained herein. Past performance is not a reliable indicator of future performance.