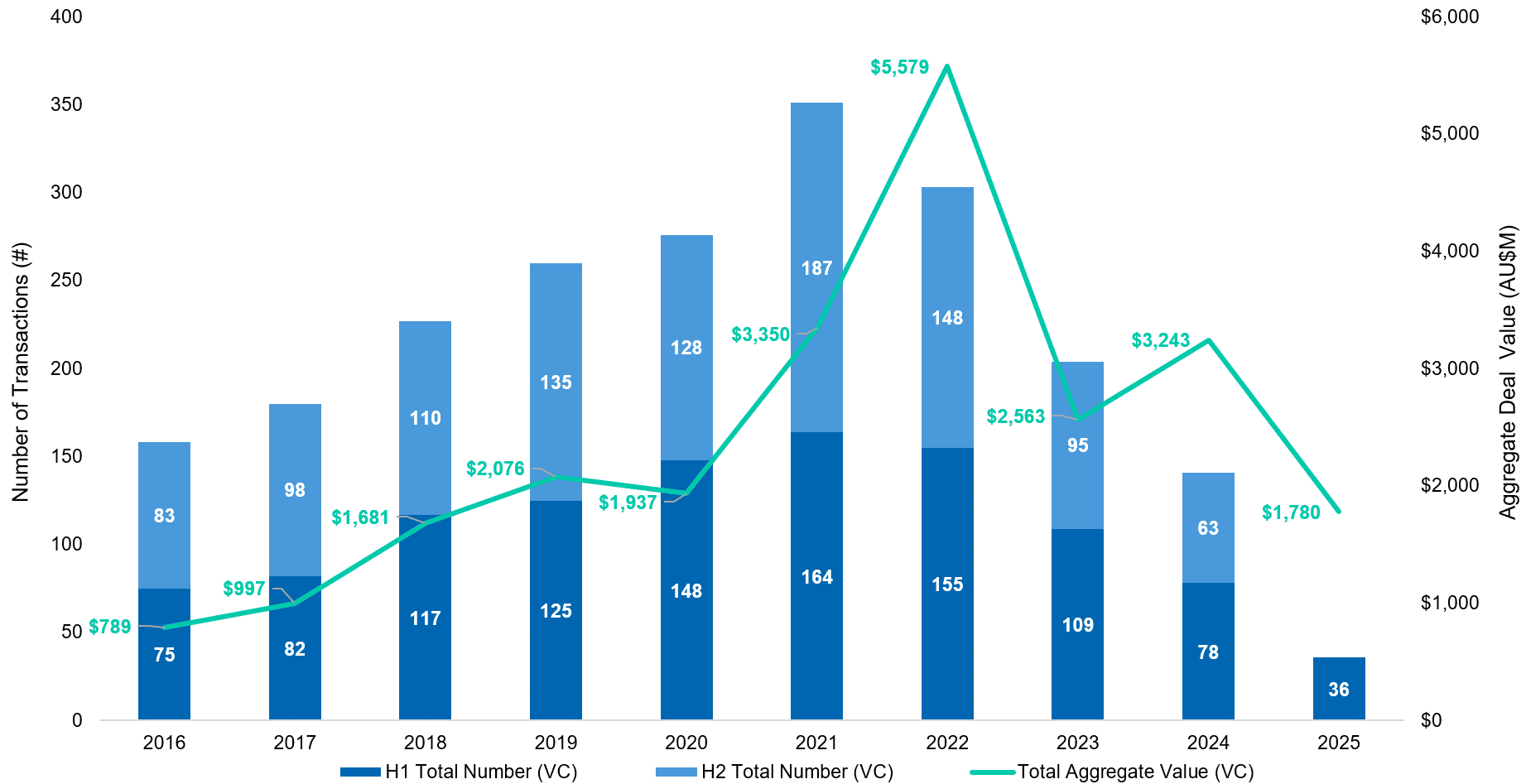

In the first half of 2025 Australia’s venture capital market remains subdued, with 36 investments completing, down from 78 in 2024 and 109 in 2023. Capital is concentrated towards technology startups, with $408m in disclosed capital deployed across 20 investments. Capital flows more rapidly and at higher multiples to technology companies developing innovative AI solutions across industries. AI also broadly benefits the ecosystem, enabling start-ups to reach minimum viable product (MVP) more rapidly and nimbly, leveraging no-code solutions to iterate more effectively.

Broader market uncertainty and still elevated interest rates have contributed to the decline in deal activity. There’s a renewed focus on slowing cash-burn and achieving a path to profitability. This has translated to VCs increasing their reliance on Simple Agreements for Future Equity (SAFE) notes to avoid a priced-down round. Deals are also taking longer to complete and entrepreneurs have had to concede on less favourable terms to raise funding.