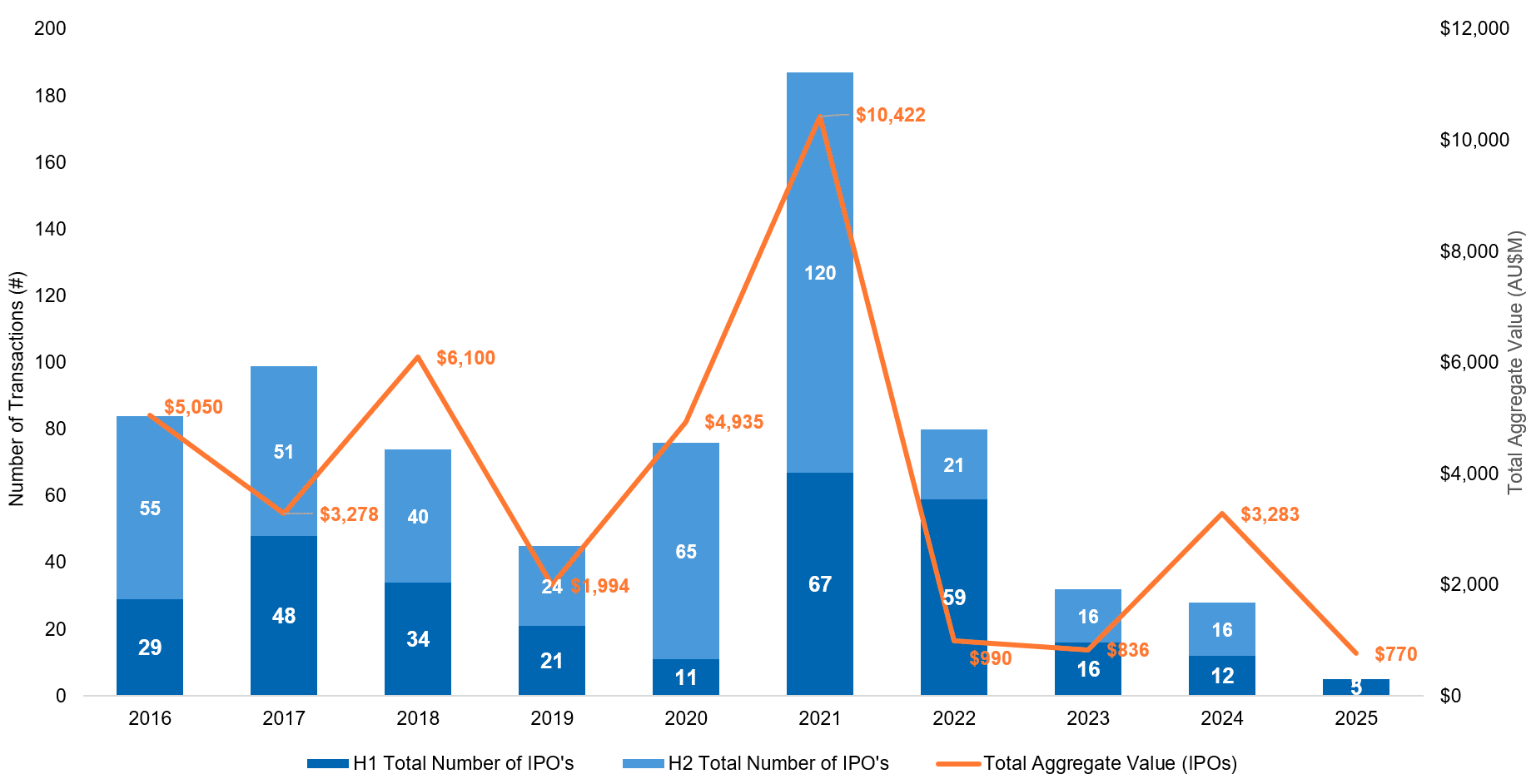

IPO activity (half-split) (2016-1H2025)

The IPO market has struggled to rebound to pre-pandemic highs. Just five IPOs were recorded in the first half of 2025, according to S&P Capital IQ. Total deal value has also decreased to $770m created thus far, of which Virgin Australia’s listing contributed $685m.

The subdued IPO market is not isolated to Australia. Most large exchanges are observing stabilising or decreasing numbers of listed companies due to increasing compliance requirements and associated fees, greater capital abundance, optionality and market volatility.

Virgin Australia’s listing represents the complementary relationship between the private and public capital markets; Bain Capital acquired the company for $3.5b in 2020 during its voluntary administration process. The turnaround success has generated a 3.5x return on investment as of June 2025, with an expected return of 5x if its current valuation holds until Bain can exit in 2027. The Virgin Australia deal highlights the critical role that private markets can play in restructuring struggling companies for growth and utilising the public markets for exit opportunities.