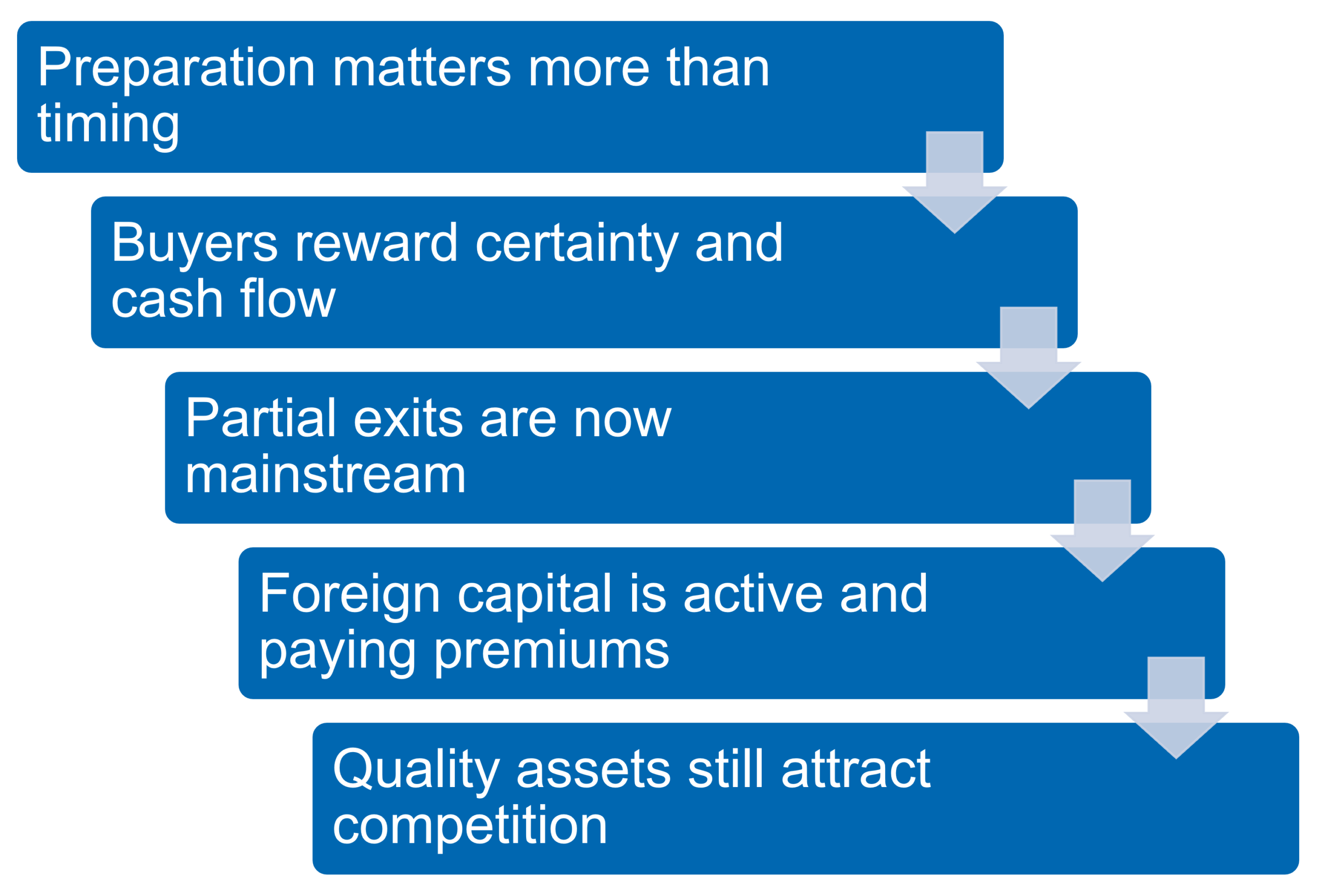

If you are an Australian mid-market business owner considering growth, succession, capital raising or an exit in 2026, the dealmaking landscape presents both challenges and opportunity.

From mergers and acquisitions (M&A) to private equity partnerships and selective IPOs, there is no single right pathway – but there is a right pathway for your business, your timing and your objectives.

William Buck’s 2026 Dealmaking Insights report examines deal activity across M&A, private capital and listed markets over the past decade and through 2025, highlighting what has changed. We call out what it means for business owners navigating an environment shaped by geopolitical uncertainty, tighter regulation, higher scrutiny from buyers and lenders and evolving capital structures.

For mid-market businesses, where most Australian deal activity occurs, preparation, clarity and optionality have never mattered more.