As a follow-up to William Buck’s extensive Dealmaking Insights Report 2023, this half-yearly update summarises Australia’s M&A, IPO, Private Equity and Venture Capital markets for the first half of the calendar year, 2023. We also look at the global state of dealmaking, particularly in the M&A space.

1. Current dealmaking trends

3. Global M&A trends

1. Current dealmaking trends

Prevailing economic challenges, including heightened interest rates and inflation, have significantly reduced risk appetite in the middle-market, hampering dealmaking activity both at home and globally.

2. Mergers and Acquisitions (M&A) trends

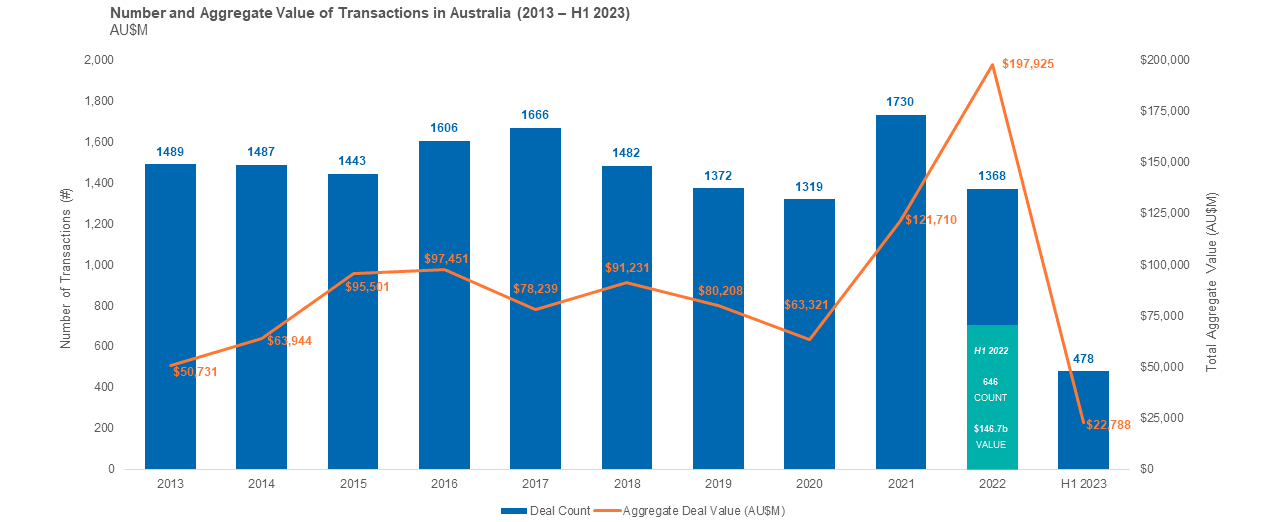

A convergence of factors including inflationary pressures, higher interest rates, supply chain challenges, increased regulation and geopolitical tensions have caused M&A activity to plunge in the first half of 2023 which has seen the lowest aggregate deal value ($23bn) in over a decade. Deal volume has also declined significantly.

The mid-market remains a promising sector for investors as transactions up to $50m accounted for 77% of the total number of transactions in H1 2023. Smaller businesses also continued to attract investment, with transactions up to $10m accounting for 38%.

Key points

- Aggregate deal value of M&A transactions in Australia has decreased 84% in H1 2023 from H1 2022 – at $23bn compared with $146.7bn.

- Deal volume has declined by 26% from 646 in H1 2022 to 478 in H1 2023.

- There’s been a marked reduction in megadeals compared to H1 2022, specifically in the Energy and Utilities, Industries, and Financials sectors. This is again attributed to reduced risk appetite and increased cost of debt in the market.

- Local buyers have accounted for 76% of the value of all transactions in H1 2023, the largest percentage in a decade.

Total Number M&A Transactions per Size Category

Transactions with a value up to $10 million constitute 38% of the total number of transactions thus far in 2023.

Total M&A Volume and Aggregate Value in Australia

In the first half of 2023, the aggregate value of M&A Transactions in Australia decreased 84% from H1 2022 ($146.7 billion) to $23 billion, the lowest in over a decade. Deal volume also declined by 26% compared to H1 2022, from 646 to 478.

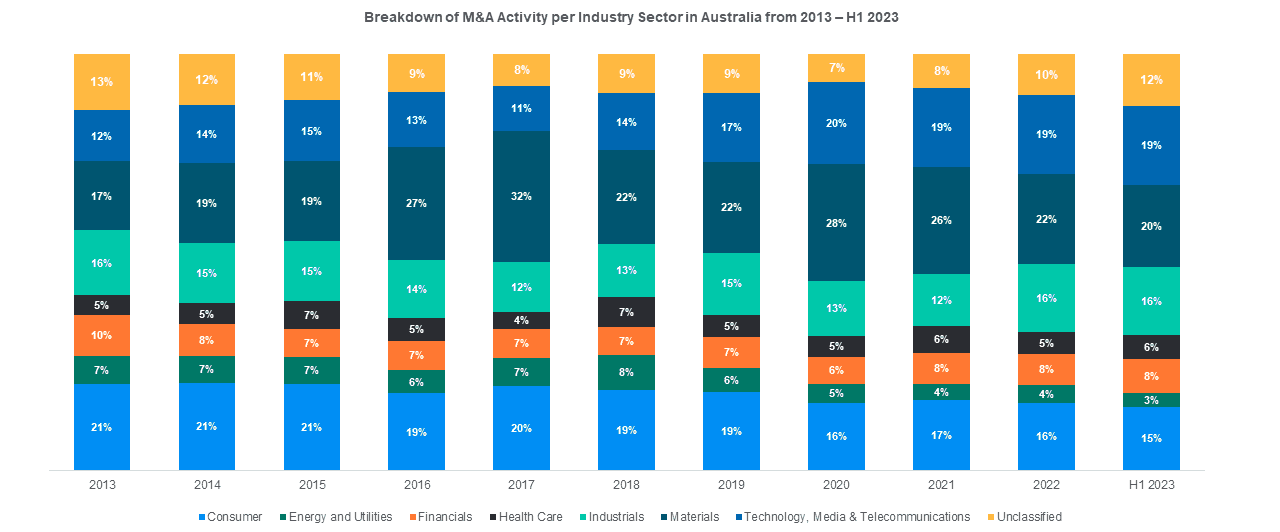

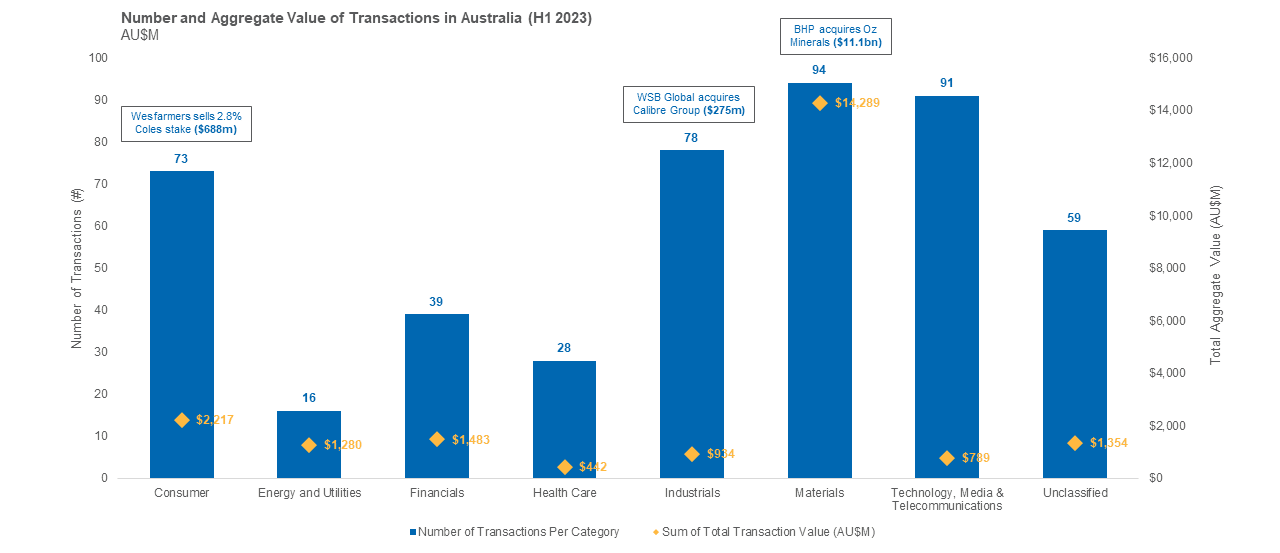

Sector performance

- The largest industry sectors by deal count in H1 2023 were Materials (20%), Technology, Media, and Communications (19%) and Industrials (16%).

- In terms of value, Materials was also the best-performing or largest sector, with an aggregate value of $14.3bn. Consumer followed with a value of $2.2bn.

Industry Sectors of Australia’s Total Market

Largest Industry Sectors by deal count in 2023 were Materials (20%), TMT (19%) and Industrials (16%).

Total M&A Volume and Aggregate Value in Australia during H1 2023 per Industry Sector

Largest industry sector by deal count was Materials (94). Highest by value was Materials ($14.3bn), followed by Consumer ($2.2bn).

3. Global M&A trends

The global M&A market saw a steep decline from H2 2022 to H1 2023 due to sustained macroeconomic uncertainty driving up inflation and the tightening of macroeconomic policy. Company valuations were driven down in response to future cash flows being discounted at higher rates.

Key points

- Globally, the M&A market declined in value by 19% from H1 2022 to H1 2023, from $1.82 trillion to $1.47 trillion.

- There was a notable decrease in Technology, Media, and Communications investment compared to prior periods. During H1 2023, it accounted for 14% of the total global aggregate M&A total.

- Aggregate deal value of Industrials also declined as a proportion of total sector value, driven by a two-fold decrease in transaction value, declining from $360bn in H2 2022 to $185bn in H1 2023, as well as a slowdown in deal activity.

4. IPO trends

Elevated volatility in the first half of 2023, as a result of current economic uncertainty and geopolitical unrest within the global macroeconomic environment, has suppressed activity, with only 15 IPOs thus far in 2023 as compared to 56 in H1 2022.

Key points

- The total number of IPOs in Australia in H1 2023 dropped 73% when compared with the same period last year, from 56 IPOs to 15.

- The aggregate value of IPOs decreased by 80% to only $150m in H1 2023 from $768m in H1 2022. This is the lowest value in a decade.

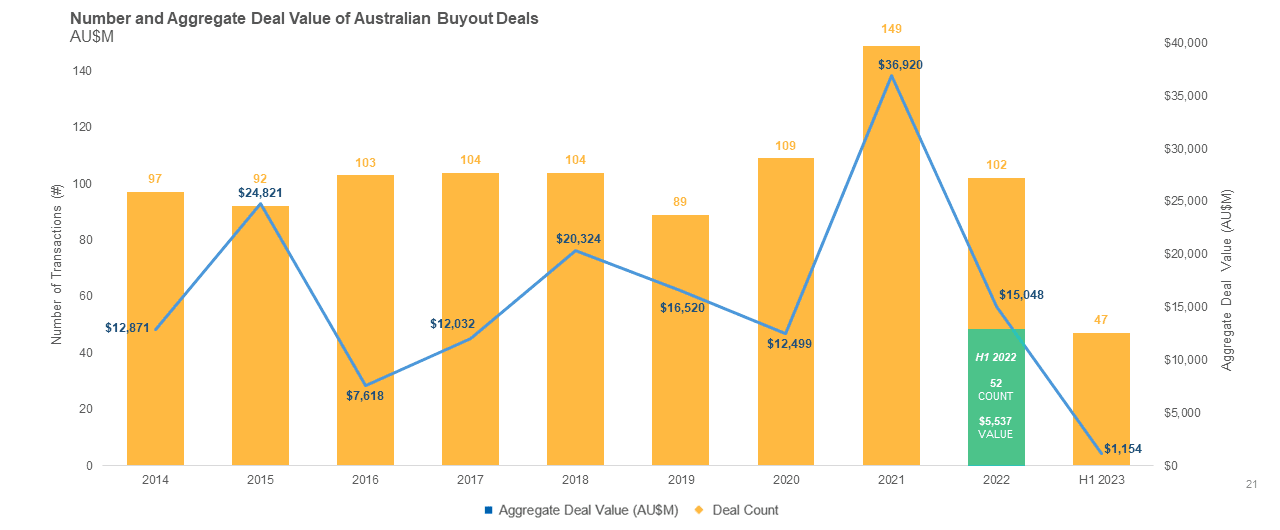

5. Private Equity (PE)

Key points:

- Private equity transactions in Australia during the first half of 2023 had the lowest aggregate deal value over the last 10 years at $1.1bn, representing a 79% decline to the corresponding period last year which saw $5.5bn in deal value.

- The strongest performing sectors over the last 10 years for total aggregate deal value were Industrials at $45.bn, followed by Energy and Utilities at $31.9bn.

- Across H1 2023, the strongest performing sectors were Consumer at $584m and Technology, Media, and Communications at $288m.

- In terms of deal count, consistent with the global private equity market, Technology, Media, and Communications has recorded the highest deal count over the 10 years and during the first half of 2023. Contrastingly, Industrials has achieved the highest aggregate deal value.

Volume and Aggregate Value in the Australian Private Equity Market

The first half of 2023 had the lowest aggregate deal value in the last 10 years ($1.1 billion). This represents a 79% decrease from H1 2022 ($5.5 billion), despite the volume of deals decreasing only incrementally from 52 to 47.

6. Venture Capital (VC)

Australian venture capital remains in a difficult adjustment period as investors reset what they are prepared to pay for riskier companies in this challenging economic environment.

- Compared to H1 2022, deal count declined by 44%, from 351 to 198, while aggregate value decreased by 49%, from $2.8bn to $1.6bn.

- Technology, Media, and Communications saw the highest deal count in H1 2023 at 83, and the highest total aggregate value at $637m. This is reflective of the last ten years in which Technology, Media, and Communications was the highest performing sector in terms of both deal count and value.

- Large deals in H1 2023 included Macquarie Capital’s $150m injection into PE-owned IT services company Orro and Australian carbon farming biotech Loam Bio securing $105m from CEFC and Grok Ventures.

Our data was sourced from S&P Capital IQ 2023, Pitchbook and Preqin.