In recent comments to the Australian Financial Review, Treasurer Scott Morrison has revealed there will be changes to the R&D tax incentive that will be announced in the upcoming (pre-election) Federal Budget.

By way of background, in 2016 Innovation and Science Australia released a Review of the R&D tax incentive which contained 6 recommendations to the government. Since then, the government have yet to issue a policy response, although the ATO has been very active with compliance activity and Taxpayer Alerts which merely enforce existing rules. Some media attention has been focused on review and audit activity amid perceptions of poor compliance in some sectors, however now attention will now turn towards new policies.

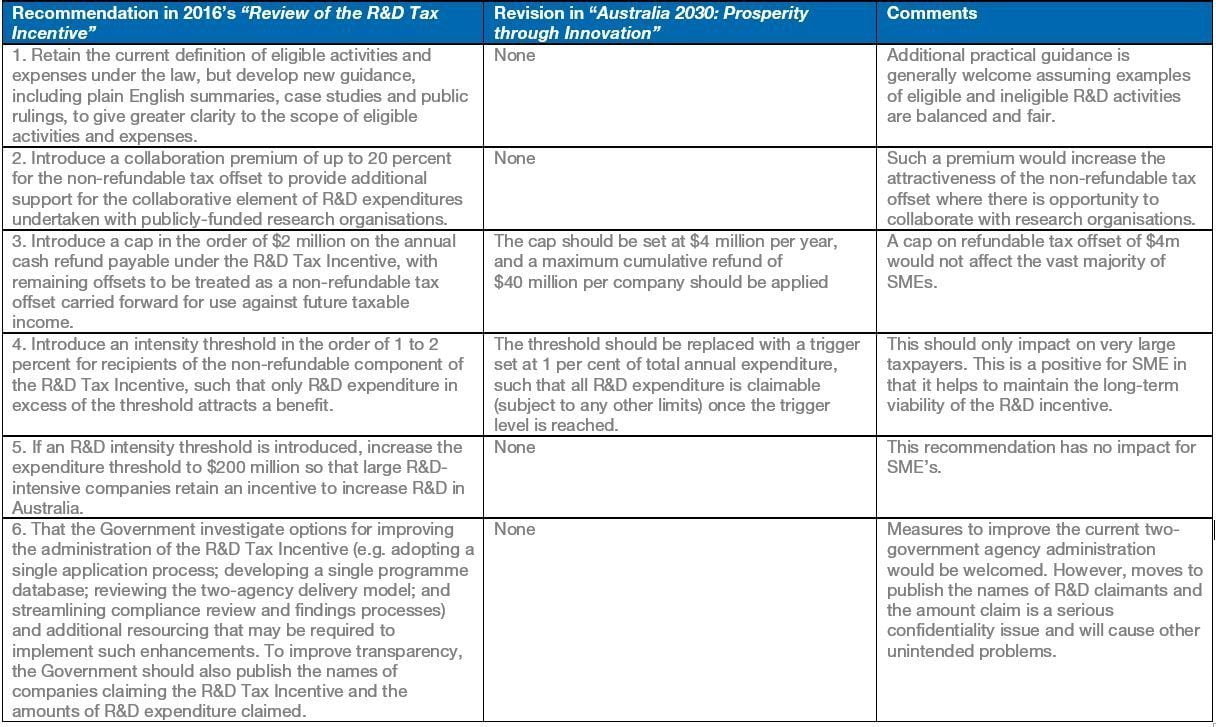

In their recent report Australia 2030: Prosperity through innovation, Innovation & Science Australia published their latest thinking by revising two of their 2016 recommendations. This report is a strategy document designed to guide policy-makers on how to optimise Australia’s innovation and is much broader than just the R&D incentive. Below is a summary of the review recommendations relating to R&D, some or all of which may be incorporated in the Budget.

Other matters of note in Australia 2030: Prosperity through innovation

- One key change to the R&D tax incentive the technology and entrepreneurial community has been calling for – changing the refund from an annual payment to a quarterly basis – appears to have fallen by the wayside. Whilst such a system would pose some administrative complexities, there is a strong argument that it would give a critical boost to the sector.

- The report recommended increasing Export Market Development Grants funding – in the last few years only 70-80% of amounts claims are paid out by the government due to budget restrictions. Hopefully with increased funding the entire claim made by claimants can be paid out.

- The report is very “pro-SME business” which explains some of the above recommendations – it notes that “The consultations undertaken by ISA to develop this plan confirmed the importance of the R&DTI, particularly for small and medium enterprises (SMEs). SMEs generate greater additionality per dollar spent on R&D tax incentives by governments compared with large businesses; SMEs generate between 0.9 and 1.5 additional dollars per dollar of tax forgone, versus just 0.3 to 1.0 for large firms. In many cases SMEs are also more sensitive to the R&DTI than larger and more established firms: 54 per cent of SMEs’ decisions regarding R&D are influenced by the R&DTI program, versus 34 per cent of decisions for larger entities”.

- Recommended prioritising programs that directly support activity in areas of competitive strength and strategic priority (e.g. Cooperative Research Centres – CRCs, CRC Projects, Entrepreneurs’ Programme and Industry Growth Centres).