As the holiday season approaches, both the Federal and Victorian governments have delivered early regulatory updates that will significantly impact landowners in the new year.

With the release of fresh guidelines for the Vacant Residential Land Tax (VRLT) in Victoria and a tighter stance from the Australian Taxation Office (ATO) on holiday home deductions, property owners must now navigate a more complex compliance landscape.

Federal – holiday homes in the crosshairs

From 1 July 2026, the ATO is set to tighten its treatment of deductions associated with holiday homes, releasing its guidance in TR 2025/D1 and how it will administer the law in PCG 2025/D6.

Even though this is a draft position, the ATO is seeking to clarify the limit of deductions available to claim against holiday homes, particularly those in seasonal locations such as coastal areas or the alpine regions.

The guidance outlines the Australian Taxation Office’s (ATO) current stance regarding the requirements for making a property available for rent and its primary use, reflecting a shift from previous practical approaches. The ATO has identified several indicators that a property may be considered a holiday home rather than a rental property, including:

- Not making a property available for rent during peak season

- Setting rent unreasonably high

- Restricting guest access (i.e. for kids or pets) or

- Renting it mostly to related parties or friends at below-market rates

If a property is classified as a holiday home under these criteria, it will result in significant limitations on allowable deductions.

Victoria’s VRLT

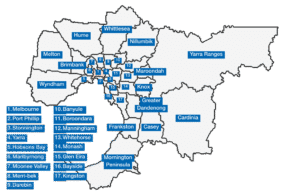

New VRLT provisions take effect from 1 January 2026 and apply to undeveloped residential land in the following areas of Metropolitan Melbourne. Such properties will attract a 1% tax in addition to any existing land taxes payable from 1 January.

The 1% rate increases by a further 1% for each consecutive year it triggers VRLT (up until a cap of 3%)

What is Metropolitan Melbourne?

Source: Understanding vacant residential land tax | State Revenue Office

What is undeveloped residential land?

Undeveloped residential land is land that is capable of residential development, and:

- Was in one of the above council areas and

- As of 31 December, of the proceeding tax year, was undeveloped and

- As of 31 December, was undeveloped for a continuous period of 5 years of more.

There are exclusions for certain undeveloped land where the relevant zoning under the council’s planning scheme lists that land for non-residential use, or if it is being developed for a non-residential use. In these circumstances, the land is not suitable for residential development or utilisation as residential property.

If the land is sold by the landholder, the buyer refreshes the 5 year period, with the policy intent being to allow the new owner sufficient time to commence any construction activity.

Notably, the Commissioner of State Revenue has a discretion to not classify land as undeveloped (i.e., vacant) for a particular year if the Commissioner determines that both conditions are met:

- A residence is to be constructed on the land and

- There is an acceptable reason for the construction not having been commenced.

One of the requirements of the discretion is that the Treasurer must publish guidance on the relevant considerations that the Commissioner will look at in determining acceptable reasons for any delays in construction. We summarise these considerations for you below.

What is the new guidance?

Treasury guidance in Victorian Government Gazette No. S634 explains how the Commissioner assesses delays in developing vacant residential land. In simple terms, the key question is whether the delay was caused by something unexpected and outside the owner or developer’s control.

Examples include unforeseen cultural heritage, archaeological or environmental issues (such as the discovery of endangered flora or fauna), extreme weather that prevents construction from starting, or the lack of essential infrastructure or utility connections that the owner cannot control.

Lengthy planning or approval processes, regulatory disputes or appeals, the unexpected loss or unavailability of critical specialist personnel and other exceptional events such as pandemics, the death of key personnel or sudden regulatory change may also be considered.

By contrast, delays caused by normal commercial or market conditions are generally not accepted. This includes rising or uncertain construction costs, waiting for better market conditions, general labour shortages and common supply chain delays. Changes to designs or specifications made for commercial reasons, as well as difficulties obtaining finance or complying with loan covenants, are treated as risks that sit with the owner or developer and are therefore unlikely to support an exemption or relief from vacant residential land tax on undeveloped land.

What should you do?

For property developers

If you are currently evaluating potential developments or have developments experiencing delays that may result in land being undeveloped for 5 years as of December 2025, we recommend you seek advice to understand the implications for you and project cash flows.

Understanding your obligations and building a pathway from planning to execution will become more critical now than ever before.

For other landholders

For individuals and entities with rental properties that include holiday homes, we recommend seeking advice as to the impact of this draft guidance ahead of it being finalised.

As we head into 2026, we recommend clients review their holiday homes or rental properties that could fall foul of the draft guidance.

Get in touch with William Buck’s property team now to understand how the above could impact you.