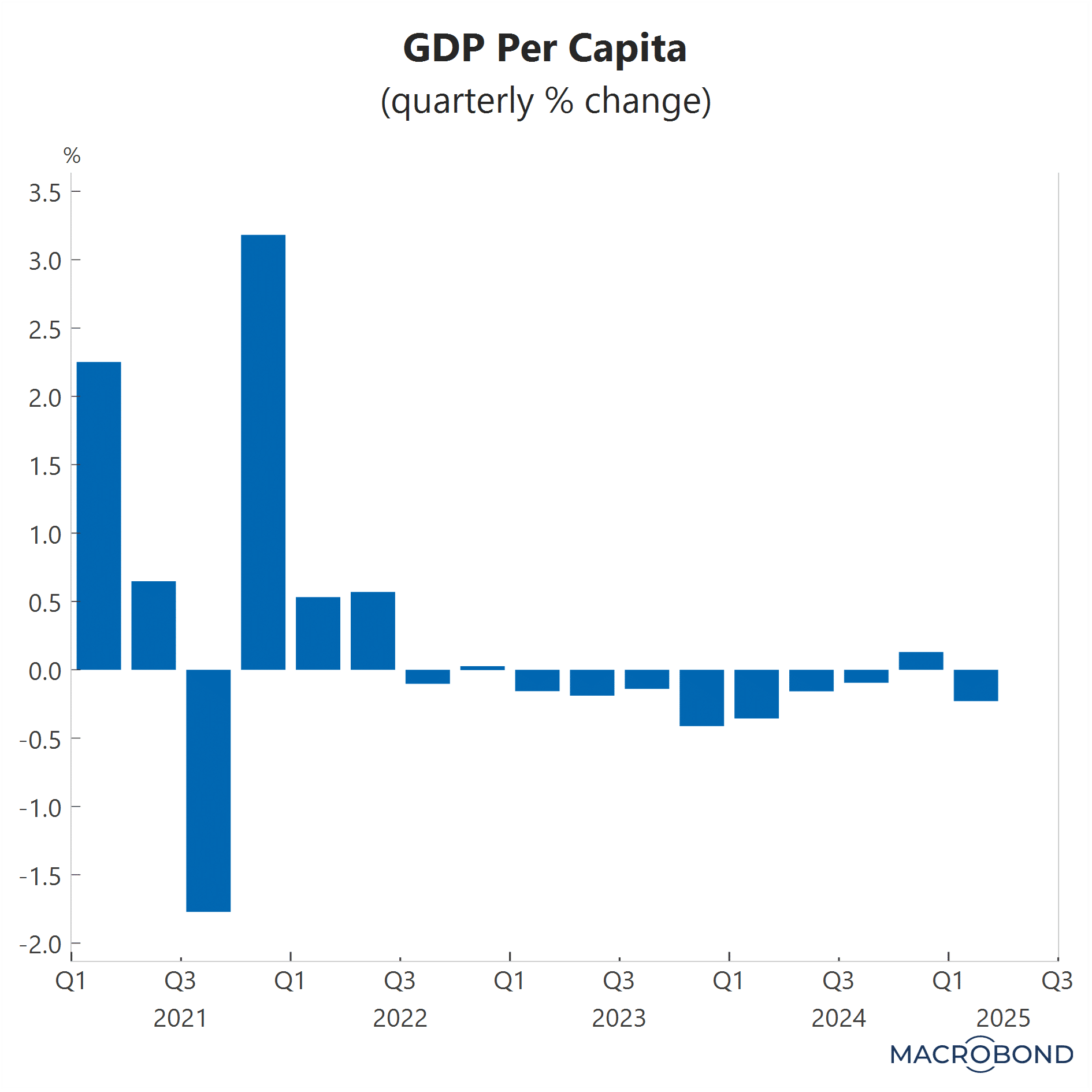

The Australian economic recovery from its low point around the middle of last year remains sluggish. Data published today showed the Australian economy expanded by only 0.2% in the March quarter, a step down from the 0.6% increase recorded in the final quarter of last year.

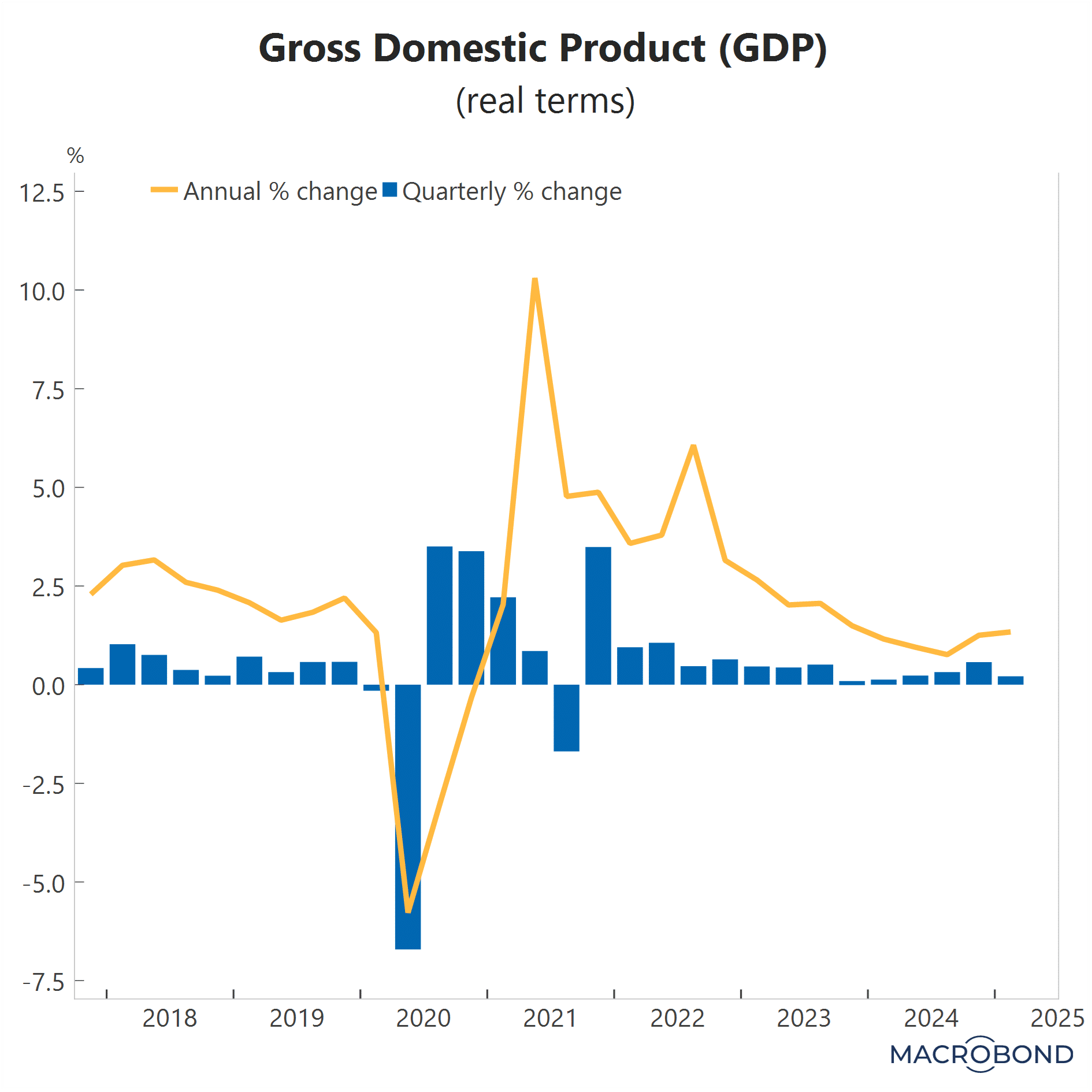

In year-on-year terms, gross domestic product (GDP) expanded by 1.3%, which is significantly below the average pace of 2.3% recorded over the past decade. Annual GDP growth has only gradually increased since the low point of 0.8% in the June quarter of 2024, highlighting the still fragile nature of the recovery.

There were special factors that weighed on growth, namely the flooding and winds in New South Wales and Queensland during the quarter. These weather-related disruptions particularly impacted mining, tourism, shipping and exports.

The other main drag on economic activity was the government sector. Both public investment and consumption declined in the quarter. Whilst there is a healthy level of work in the pipeline, public investment edged lower. Moreover, government consumption fell, as the electricity rebates paid to households by state and local governments slowed in the quarter.

It leaves the Reserve Bank (RBA) vindicated in its decision to cut the cash rate last month by a quarter of a percent to 3.85%. While the GDP data for the March quarter may seem outdated as we near the end of the June quarter, it unequivocally indicates that the Australian economy commenced the new year in a state of fragile recovery.

The downside risks to trade and global growth from United States tariff policy means the RBA cannot afford to stop easing. The rise in longer-dated bond yields would also be tightening financial conditions (please refer to my insights from 2 June on global bond markets and the divergences in markets).

We continue to expect a rate cut in July, which remains a non-consensus view. The widely-held consensus view among economists is that the RBA will cut again, but wait until August. In contrast, interest-rate markets have a probability of 85% attached to a rate cut as soon as July.

The RBA on the domestic front is watching trends in household spending closely. The July tax cuts helped spur spending by consumers, but it was a modest boost. In the March quarter, household spending growth stayed at the same pace as that of the December quarter. The household savings ratio continued to rise, reaching 5.2%, the highest in 2½ years. It reflects a level of caution gripping consumers. Without a more meaningful recovery in spending by households, the important handover of economic activity from the public sector to the private sector remains wobbly. Rate cuts will help reduce the wobbliness. The handover is essential to strengthen Australia’s economic recovery. Trade disruptions demand a stronger recovery now more than ever.

The information in this article is general in nature, intended for informational purposes only and does not constitute financial, investment, legal or professional advice; readers should seek guidance from qualified professionals before making decisions based on its content.