As your property specialists, we offer a scalable solution to help you from start to finish so you can develop your property with confidence.

Whether you’re a sophisticated property developer, an asset manager or just starting out, you’ll face a myriad of commercial considerations, business decisions and tax issues with far-reaching implications.

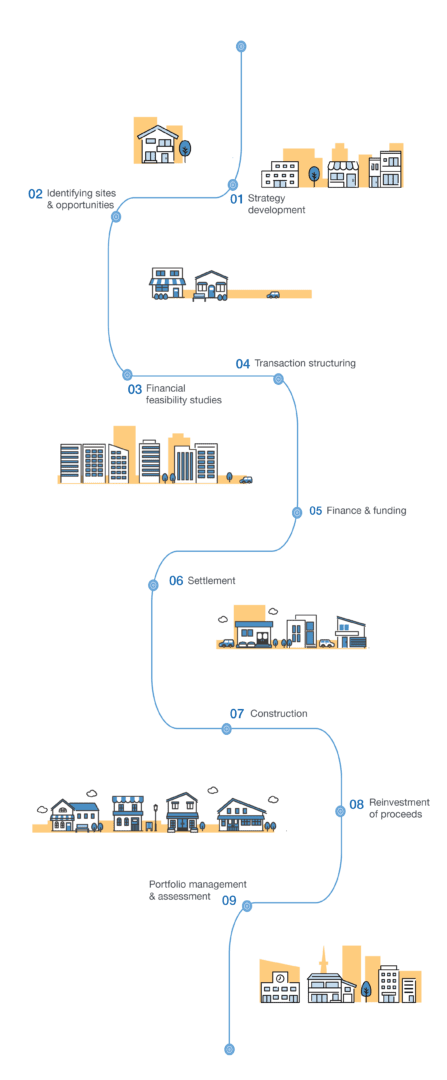

We’re here to help you lay a solid foundation by structuring your project in a commercially attractive manner while managing your tax position to maximise project return. Our scalable solution means you can engage us for a specific part of your development or the entire project.

Our dedicated team of property specialists is comprised of professionals who focus exclusively on property and understand the challenges you face. With over 35 years’ experience in the sector, we have access to an extensive network of key players within the industry and pride ourselves on building value through the cycle of property acquisition, ownership, development and sale.